Well, what do you know. SMC shoot right up today because of the news of the offering will not be postponed and now priced at 200-250. Coincidentally, the gap today points to 211 as a target in the short term so I'll be keeping this one for a while. I also increased my position today.

I put up a position in SCC today at the closing.

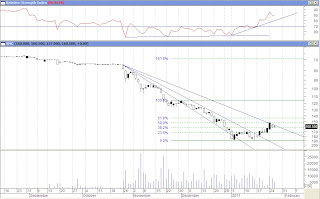

NIKL showed alot of hot love today, peaking at 21.20 before closing at 20.90, also filling the intraday gap(5-minute)at 20.80. Data on my previous analysis of the chart is updated 'cept for the chart.

SOLD APC for a loss today.

SOLD AGI at 11.96. I was being stupid and greedy that it will push higher into mid-12s today while my analysis is just pointing at 11.98 so I sold a fluctuation lower.

ATR was very active in this stock today but I don't think I am willing to bet on them yet. There was also a huge cross by UBS. I am skeptical with this cross sale as I feel like cross sales at the top end of the range is distribution. Or maybe I am simply being paranoid.

Still holding ELI. What a sucky position. I want to break free.

The index might meet resistance at 4090 in the short term so that leaves us with 2% gain in one day(doubt it) or 1% gain in 2 days which would mean that the resistance will be met by Monday.

*Heavily monitoring the Index as I am only comfortable trading index issues.

***I just got the daily quotation report and have I read it right? Around 1B NFB?!

Disclaimer: The content posted in this blog is for informational purposes only and it should not be taken as an endorsement or solicitation to buy/sell the aforementioned issues. The information posted here is obtained through personal research and analysis, reserving the right to change them anytime. Investing in the money markets is accompanied by substantial risks to one's capital.

Thursday, January 27, 2011

Risk-Reward of closed trades

Updated on every closed trades

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0