Besides the fact that the index got severely murdered in today's trading, nothing much happened in today's session. The index wasn't spared from the turmoil overseas(Egypt), closing 2.24% lower from yesterday. As of writing, Asian markets are down by more than 1% so that still makes us the biggest loser, second to NASDAQ's drop last Friday at -2.48%.

The drop was led by TEL -0.73%, AP -5.29%, MER -6.93%, BPI -4.98%, AC -5.29%,

SM -3.89%, AGI -2.71%, and MBT -2.55%.

Panic selling was seen everywhere. My core stock - NIKL - experienced its heaviest drop today, dropping to 19 before closing 19.54, 4.68% lower from yesterday.

The drop today left huge gaps at (20.50 and 20.10) and (19.90 and 19.70) visible on the 5-minute candlestick chart.

I am expecting the gap at 19.90-19.70 to be filled in the next few days but I am having doubts that the gap at 19.90 will be filled immediately.

I put up another small position at 19.44 today.

SCC is very heavy, closing almost unchanged at 198.90 - my original entry. I am hoping that it rebounds in the short term as Oil is starting to move up again.

It looks like it's forming a symmetrical triangle on the daily chart.

Yikes with LC. Timing of entry is a little off but the stock is moving within expectations. Rising method candle pattern on the weekly chart.

I couldn't make anything out of SMC so I wont be touching it in the short term or until it fills the gap.

AP seems to be forming a symmetrical triangle pattern(bearish) on the daily chart.

I am patiently waiting for AGI.

The game has definitely changed. Dead cats, anyone?

Disclaimer: The content posted in this blog is for informational purposes only and it should not be taken as an endorsement or solicitation to buy/sell the aforementioned issues. The information posted here is obtained through personal research and analysis, reserving the right to change them anytime. Investing in the money markets is accompanied by substantial risks to one's capital.

Monday, January 31, 2011

Friday, January 28, 2011

Trading plan

Here is the trading plan that I made for this past week:

I never took position in MEG but in SMC instead.

Avoid/Sell holding and industrial stocks.

Buy financial and property stocks for oversold/technical bounce play.

Buy mining stocks for bucking the short/medium term downtrend but be extra careful.

Check for bearish rsi divergences to spot weakness as weakness has already starting to surface.

Take positions in leaders.

MEG in property sector.

NIKL/LC/SCC in mining sector.

General market short to medium term trend is down.

I never took position in MEG but in SMC instead.

I told you so.

I was judging SMC strength the entire time today on to whether I would sell it or not by watching the price action and the 5-minute chart. There seemed little appetite for shares above 178 so I sold mine to lock in profits.

Although there were only few shares asked at 176.50, nobody wanted to take it and everybody was just waiting at 176. This is after I already sold my shares to the market. Then it was bid up at the closing back to 178. But the charts never lie, and I saw a symmetrical triangle on the 5 minute chart breaking down suggesting further decline to 169.50. RSI on the 5-minute chart looks pretty ugly too so I am just simply waiting for it to get oversold before getting back in.

I probably should not add up positions after they gap as I should be looking to "fade" the gap instead.

NIKL seems like it is poised for another correction, probably up to 20.30 before heading back up. 5-minute uptrend line is holding up so far.

A bearish RSI divergence appeared on the daily charts though. However, the divergence happened below the oversold levels so I'll be taking it as a normal correction for the mean time.

SCC just moved sideways today. A convincing break of 203 will point to advance/s in the short term. What I hate with the stock is its ROC is pointing up while its price is simply stagnating at the current levels.

I put up a position in LC today at the closing.

MA and MAB broke out of their consolidation channel. MA closed at its resistance which I believe will not be broken as the RSI reading is already on the overbought levels. The main problem of this kind of issues is they are highly illiquid meaning minimal public participation rendering technical analysis useless as the analysis is used to gauge/predict herd mentality.

It's going to be a different story if both starts to trend up again.

I hate to say this but I told you so. Somebody is shooting his foot in AGI - talking about the short term.

So there. Ending up the week with mining stocks and recovering costly mistakes by playing with the third liners.

**I was also became anxious of closing "weak" positions as my Uncle called me to buy BEL and LND. Somebody who doesn't know how to trade is telling me how to trade. How ironic. Guess what happened to both issues?

Although there were only few shares asked at 176.50, nobody wanted to take it and everybody was just waiting at 176. This is after I already sold my shares to the market. Then it was bid up at the closing back to 178. But the charts never lie, and I saw a symmetrical triangle on the 5 minute chart breaking down suggesting further decline to 169.50. RSI on the 5-minute chart looks pretty ugly too so I am just simply waiting for it to get oversold before getting back in.

I probably should not add up positions after they gap as I should be looking to "fade" the gap instead.

NIKL seems like it is poised for another correction, probably up to 20.30 before heading back up. 5-minute uptrend line is holding up so far.

A bearish RSI divergence appeared on the daily charts though. However, the divergence happened below the oversold levels so I'll be taking it as a normal correction for the mean time.

SCC just moved sideways today. A convincing break of 203 will point to advance/s in the short term. What I hate with the stock is its ROC is pointing up while its price is simply stagnating at the current levels.

I put up a position in LC today at the closing.

MA and MAB broke out of their consolidation channel. MA closed at its resistance which I believe will not be broken as the RSI reading is already on the overbought levels. The main problem of this kind of issues is they are highly illiquid meaning minimal public participation rendering technical analysis useless as the analysis is used to gauge/predict herd mentality.

It's going to be a different story if both starts to trend up again.

I hate to say this but I told you so. Somebody is shooting his foot in AGI - talking about the short term.

So there. Ending up the week with mining stocks and recovering costly mistakes by playing with the third liners.

**I was also became anxious of closing "weak" positions as my Uncle called me to buy BEL and LND. Somebody who doesn't know how to trade is telling me how to trade. How ironic. Guess what happened to both issues?

Thursday, January 27, 2011

Breaking free.

Well, what do you know. SMC shoot right up today because of the news of the offering will not be postponed and now priced at 200-250. Coincidentally, the gap today points to 211 as a target in the short term so I'll be keeping this one for a while. I also increased my position today.

I put up a position in SCC today at the closing.

NIKL showed alot of hot love today, peaking at 21.20 before closing at 20.90, also filling the intraday gap(5-minute)at 20.80. Data on my previous analysis of the chart is updated 'cept for the chart.

SOLD APC for a loss today.

SOLD AGI at 11.96. I was being stupid and greedy that it will push higher into mid-12s today while my analysis is just pointing at 11.98 so I sold a fluctuation lower.

ATR was very active in this stock today but I don't think I am willing to bet on them yet. There was also a huge cross by UBS. I am skeptical with this cross sale as I feel like cross sales at the top end of the range is distribution. Or maybe I am simply being paranoid.

Still holding ELI. What a sucky position. I want to break free.

The index might meet resistance at 4090 in the short term so that leaves us with 2% gain in one day(doubt it) or 1% gain in 2 days which would mean that the resistance will be met by Monday.

*Heavily monitoring the Index as I am only comfortable trading index issues.

***I just got the daily quotation report and have I read it right? Around 1B NFB?!

I put up a position in SCC today at the closing.

NIKL showed alot of hot love today, peaking at 21.20 before closing at 20.90, also filling the intraday gap(5-minute)at 20.80. Data on my previous analysis of the chart is updated 'cept for the chart.

SOLD APC for a loss today.

SOLD AGI at 11.96. I was being stupid and greedy that it will push higher into mid-12s today while my analysis is just pointing at 11.98 so I sold a fluctuation lower.

ATR was very active in this stock today but I don't think I am willing to bet on them yet. There was also a huge cross by UBS. I am skeptical with this cross sale as I feel like cross sales at the top end of the range is distribution. Or maybe I am simply being paranoid.

Still holding ELI. What a sucky position. I want to break free.

The index might meet resistance at 4090 in the short term so that leaves us with 2% gain in one day(doubt it) or 1% gain in 2 days which would mean that the resistance will be met by Monday.

*Heavily monitoring the Index as I am only comfortable trading index issues.

***I just got the daily quotation report and have I read it right? Around 1B NFB?!

Risk-Reward of closed trades

Updated on every closed trades

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0

Wednesday, January 26, 2011

Sucker market.

What a sucker market. Good thing the bombing yesterday didn't have much effect in today's trading.

I feel like somebody is going to shoot his own foot in AGI this week. He started shooting when locals started to buy it up to 11.80. I was looking at the 5 minute chart and the gap at 11.80 has been filled already. Next gap is at 11.94.

There was a tug of war in NIKL at 19.98. Looks like the bulls won - for now.

LND sure does look interesting.

LC is already at its uptrend support line. Expect to test 0.561 in the short term.

Changing trading strategy to properly suit up this kind of market.

I feel like somebody is going to shoot his own foot in AGI this week. He started shooting when locals started to buy it up to 11.80. I was looking at the 5 minute chart and the gap at 11.80 has been filled already. Next gap is at 11.94.

There was a tug of war in NIKL at 19.98. Looks like the bulls won - for now.

LND sure does look interesting.

LC is already at its uptrend support line. Expect to test 0.561 in the short term.

Changing trading strategy to properly suit up this kind of market.

Tuesday, January 25, 2011

Start of the emotional rally?

Looks like the market just started its recovery. It feels like an emotional rally after 5 days of heavy bleeding. I am expecting immediate resistance at 4200 levels.

Every position in my portfolio started to recover today as well. AGI is the only one acting retarded in this strong market. Annoying little bugger. Sell on rally. Formed another doji today. Possibly gathering enough strength to challenge 12 again.

APC is got bid up again today with 10M shares. Although it has closed unchanged(doji) today, with this market you'll never know so I'll be selling on rally and take some money off the basura table.

MEG is showed a strong recovery today. Too bad I didn't have the balls to catch some falling knives yesterday. It could go up to 2.40 and 2.60 at most in the short term.

JGS started its reversal today. Will buy on higher trough formation.

Bought SMC at the closing and looking to range trade. Will continue to hold if it breaks 180.

Every position in my portfolio started to recover today as well. AGI is the only one acting retarded in this strong market. Annoying little bugger. Sell on rally. Formed another doji today. Possibly gathering enough strength to challenge 12 again.

APC is got bid up again today with 10M shares. Although it has closed unchanged(doji) today, with this market you'll never know so I'll be selling on rally and take some money off the basura table.

MEG is showed a strong recovery today. Too bad I didn't have the balls to catch some falling knives yesterday. It could go up to 2.40 and 2.60 at most in the short term.

JGS started its reversal today. Will buy on higher trough formation.

Bought SMC at the closing and looking to range trade. Will continue to hold if it breaks 180.

Monday, January 24, 2011

Penetration of 3896: Spring or sign of impending doom?

The index is hanging by a thread already from the support at 3896 which was also penetrated in today's session. Luckily, the market slightly recover at the end of the session closing at 3902. From the looks of it, we just entered the oversold levels.

Note: Oversold levels can remain oversold on a downtrend and vice versa.

"Good news" from the overseas doesn't seem to have effect on our market. The drop is probably about inflation.

There were hardly notable gainers for today except LPZ gaining 4.4% MER with 3.42% and SMPH with 2.50%, completely bucking the trend. Major losers today are the previous week's third line gainers.

Well today I simply sat tight and watched the ticker as panic selling ensues at the opening, recovering slightly by mid session and closing lower by the closing.

AGI closed unchanged today, forming a doji on the lower end of its trading channel which I am assuming that the candlestick is bullish as it is also accompanied by low volume(selling pressure is easing out).

There were crosses at the closing by CLSA. ATR chumped on a huge volume at around starting at 11.12.

NIKL might continue to correct in the short term as suggested by decreasing ROC. A bounce from 50 RSI levels is probably a good entry.

The third line issues did what I was expecting them to do(to disappoint) so

I am just waiting for the stops to be hit. Or sell on rallies.

I made a trading plan on CPM, PAX, MEG, and T over the weekend. Everything are going withing expectations but I decided not to execute the plan and put on additional positions at risk until I get out of the weak positions on the third line issues.

Note: Oversold levels can remain oversold on a downtrend and vice versa.

"Good news" from the overseas doesn't seem to have effect on our market. The drop is probably about inflation.

There were hardly notable gainers for today except LPZ gaining 4.4% MER with 3.42% and SMPH with 2.50%, completely bucking the trend. Major losers today are the previous week's third line gainers.

Well today I simply sat tight and watched the ticker as panic selling ensues at the opening, recovering slightly by mid session and closing lower by the closing.

AGI closed unchanged today, forming a doji on the lower end of its trading channel which I am assuming that the candlestick is bullish as it is also accompanied by low volume(selling pressure is easing out).

There were crosses at the closing by CLSA. ATR chumped on a huge volume at around starting at 11.12.

NIKL might continue to correct in the short term as suggested by decreasing ROC. A bounce from 50 RSI levels is probably a good entry.

The third line issues did what I was expecting them to do(to disappoint) so

I am just waiting for the stops to be hit. Or sell on rallies.

I made a trading plan on CPM, PAX, MEG, and T over the weekend. Everything are going withing expectations but I decided not to execute the plan and put on additional positions at risk until I get out of the weak positions on the third line issues.

PSEi: Doomsday scenario

As the moons of Mars and Earth align, just kidding.

Possible scenario for PSEi if it completely breaks down from support:

Possible scenario for PSEi if it completely breaks down from support:

Fire burning on the dance floor

Everybody is running towards the nearest exit.

Previous all time high at 3896 is broken. Next is 3820. Doomsday scenario is happening?

Previous all time high at 3896 is broken. Next is 3820. Doomsday scenario is happening?

Friday, January 21, 2011

Yikes!

Alot of bearish RSI divergences on the weekly charts. PSEi breakdown from support.

Hold your breathe and take the dive at 3800~

Hold your breathe and take the dive at 3800~

Sideways to down.

The PSEi did took the center stage as it lost another 1.38% in today's session, beating western and asian markets with the exception of FTSE. The index has also formed a new lower high and lower low in the short term and it has also broken below the previous low of 3953 - 2 points lower. The market might continue to move sideways in the intermediate term with a downward bias.

It's been a long time since I went red. Yikes.

Got faked out in APC because of the 23M bid at yesterday's closing. It has formed formed bearish candlesticks this week - Falling method followed by a bearish engulfing pattern. However, weekly chart is telling other wise - a long white candlestick and MACD buy signal so the weakness in the daily chart is probably a buy. For the past year, its weekly MACD buy signal works so I am still giving APC a week or two.

Also got faked in AGI. Weekly and daily chart looks very ugly. Should have taken whatever money it gave this week.

ELI started its recovery today. Spinning top after a decline would suggest sellers are losing control. ROC has also started to turn up so I am guessing it's about to advance in the short term. Weekly candlestick is showing a large doji which is bearish. Hopefully it opens higher this week.

NIKL is probably on correction mode.

Waiting for SCC to bounce before getting in. It seems like its going to consolidate in the short term within +/- 200 range.

AP seems to be forming a symmetrical triangle pattern(?). Also forming three stars in the south candle formations and RSI is back on its old support(39.59). Daily signs are mixed so I am not willing to bet on it yet.

Probably best to wait for:

1. Higher high (since it seems like to have formed a higher low already).

2. RSI bounce from 52 in the weekly chart.

All of the stocks that I am currently holding seems to have a normal bid/ask at the closing except NIKL which has 200k shares at 19.98.

RSI buy signal does seem to work on a 5-minute chart if the stock is range trading.

It's been a long time since I went red. Yikes.

Got faked out in APC because of the 23M bid at yesterday's closing. It has formed formed bearish candlesticks this week - Falling method followed by a bearish engulfing pattern. However, weekly chart is telling other wise - a long white candlestick and MACD buy signal so the weakness in the daily chart is probably a buy. For the past year, its weekly MACD buy signal works so I am still giving APC a week or two.

Also got faked in AGI. Weekly and daily chart looks very ugly. Should have taken whatever money it gave this week.

ELI started its recovery today. Spinning top after a decline would suggest sellers are losing control. ROC has also started to turn up so I am guessing it's about to advance in the short term. Weekly candlestick is showing a large doji which is bearish. Hopefully it opens higher this week.

NIKL is probably on correction mode.

Waiting for SCC to bounce before getting in. It seems like its going to consolidate in the short term within +/- 200 range.

AP seems to be forming a symmetrical triangle pattern(?). Also forming three stars in the south candle formations and RSI is back on its old support(39.59). Daily signs are mixed so I am not willing to bet on it yet.

Probably best to wait for:

1. Higher high (since it seems like to have formed a higher low already).

2. RSI bounce from 52 in the weekly chart.

All of the stocks that I am currently holding seems to have a normal bid/ask at the closing except NIKL which has 200k shares at 19.98.

RSI buy signal does seem to work on a 5-minute chart if the stock is range trading.

Thursday, January 20, 2011

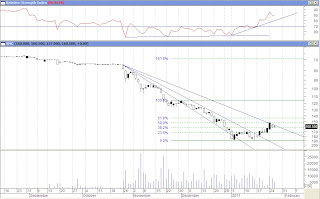

Nickel Asia (NIKL)

NIKL Daily Chart

From the looks of it, it is still a long way to go.

The higher end of the IPO price is my long term target.

From the looks of it, it is still a long way to go.

The higher end of the IPO price is my long term target.

Bleeding index is bleeding.

I am proud to say that everything I lost on the basura plays lately(plus the paper loss in ELI), I recovered back today with NIKL. NIKL is the superstar in today's session as it is bucking the Index lately. I completed my initial position in NIKL today. I wanted to add more but I didn't want to pull my average entry up too much. I will be waiting for a correction from 22 before I start adding up again.

Sold CYBR for a loss as my stops are hit during the early morning surge/slide.

APC has started to advance and it has now broke and closed above its resistance at 0.89.

Although ELI is still trading within expectations it is still losing(disappointingly). I'm still keeping it(prolonging losses) as it is somehow forming a bullish candlestick reversal pattern: Three starts in the south. Let's see how it goes in the short term.

Short term trading setup appeared in MEG and SCC. I'll toss a coin which one to trade tomorrow as I still have some cash after buying AGI for another quick range trading.

I'll post the chart of LC later as I couldn't get the clearance to trade it because of "moral issues".

The index lost another 33 points today. This suggests that the selling pressure is easing up and we are just about 6 points higher from the psychological support at 4k.

Let's see how things go tomorrow.

Sold CYBR for a loss as my stops are hit during the early morning surge/slide.

APC has started to advance and it has now broke and closed above its resistance at 0.89.

Although ELI is still trading within expectations it is still losing(disappointingly). I'm still keeping it(prolonging losses) as it is somehow forming a bullish candlestick reversal pattern: Three starts in the south. Let's see how it goes in the short term.

Short term trading setup appeared in MEG and SCC. I'll toss a coin which one to trade tomorrow as I still have some cash after buying AGI for another quick range trading.

I'll post the chart of LC later as I couldn't get the clearance to trade it because of "moral issues".

The index lost another 33 points today. This suggests that the selling pressure is easing up and we are just about 6 points higher from the psychological support at 4k.

Let's see how things go tomorrow.

Wednesday, January 19, 2011

Reminder for the whole year

Always stay with strength.

Price movements make news, not the other way around.

Now, go look for a strong stock!~

*Only problem now is I am seeing alot of bearish RSI divergences on most of the stocks that I am currently monitoring. Most of them could still advance but only in the short term.

**Western markets are dropping btw.

Price movements make news, not the other way around.

Now, go look for a strong stock!~

*Only problem now is I am seeing alot of bearish RSI divergences on most of the stocks that I am currently monitoring. Most of them could still advance but only in the short term.

**Western markets are dropping btw.

Filinvest Land (FLI) and Megaworld Corp (MEG)

FLI weekly chart:

The setup that I will be looking for before putting up position in FLI is a setup similar with the red circle, an sign of recovery in RSI after the huge drop pointed out by the bearish divergence in RSI.

We already have the huge drop in play. Waiting for sign of recovery. Profit taking would be somewhere at 53 RSI.

MEG weekly chart:

Same game plan with FLI. RSI 35 would seem to be a good place to start catching falling knives. Looks like there is still possible downside in the short term.

Both have hammer candlestick formations. However, I have bad experiences with red hammers without confirmations so I am still not touching them until signs of recovery.

The setup that I will be looking for before putting up position in FLI is a setup similar with the red circle, an sign of recovery in RSI after the huge drop pointed out by the bearish divergence in RSI.

We already have the huge drop in play. Waiting for sign of recovery. Profit taking would be somewhere at 53 RSI.

MEG weekly chart:

Same game plan with FLI. RSI 35 would seem to be a good place to start catching falling knives. Looks like there is still possible downside in the short term.

Both have hammer candlestick formations. However, I have bad experiences with red hammers without confirmations so I am still not touching them until signs of recovery.

APC Group Inc (APC)

I know I shouldn't be buying the stock first without studying its chart but I already did bought without proper research so I'll study the next position that I'll be taking.

Anyway I was trying to convince myself that buying APC was right. I think I found one:

*Bad trading habit!

APC 5-Year Weekly Chart:

1. Clearly that the major trend is up.

2. Price is currently trading(resting) at its resistance at 0.89.

3. Fresh MACD buy signal.

4. RSI reading is still not overbought.

With this being said, I might still have a couple of weeks for it to climb up before starting its really loooonnnnggggg consolidation.

Prices are poised to break that 0.89 resistance levels as the current RSI reading neutral(not yet overbought).

Once 0.89 is broken, I am expecting it to test the psychological resistance at 1 which I believe will be taken out(biased lol). After breaking the psychological resistance, 1.28 would be the immediate target.

I would close my position if:

1. price meets strong resistance 1.28;

2. weekly RSI hesitates at 75-78.

Strongest weekly RSI reading is 90(1.28).

Now that I found reasons not to be shaken out, I can sleep soundly at night again. :)

I'll study the charts before putting up a trade next time, promise!

Anyway I was trying to convince myself that buying APC was right. I think I found one:

*Bad trading habit!

APC 5-Year Weekly Chart:

1. Clearly that the major trend is up.

2. Price is currently trading(resting) at its resistance at 0.89.

3. Fresh MACD buy signal.

4. RSI reading is still not overbought.

With this being said, I might still have a couple of weeks for it to climb up before starting its really loooonnnnggggg consolidation.

Prices are poised to break that 0.89 resistance levels as the current RSI reading neutral(not yet overbought).

Once 0.89 is broken, I am expecting it to test the psychological resistance at 1 which I believe will be taken out(biased lol). After breaking the psychological resistance, 1.28 would be the immediate target.

I would close my position if:

1. price meets strong resistance 1.28;

2. weekly RSI hesitates at 75-78.

Strongest weekly RSI reading is 90(1.28).

Now that I found reasons not to be shaken out, I can sleep soundly at night again. :)

I'll study the charts before putting up a trade next time, promise!

Alliance Global Group (AGI)

Here is the weekly line chart of one of my favorite stock to trade - AGI:

*I used line chart to see the formation clearly although the pattern is also visible in the bar and candlestick charts.

It appears that a head and shoulder formation has formed on the weekly charts - which is very hard for me to ignore.

Book definition of head and shoulder pattern:

1. Needs a prior trend to reverse.

2. Left shoulder that marks the high point of the trend.

3. Head forms as a higher peak forms, exceeding the previous high. After peaking, the low of the subsequent decline marks the second point of the neckline. The low of the decline usually breaks the uptrend line, putting the uptrend in jeopardy.

4. Right shoulder forms as price advances from the low of the head which is lower than the head. The decline from the peak of the right shoulder should break the neckline.

5. Neckline forms by connecting the two lows.

Neckline break(most important part of the pattern): The pattern is not complete and the uptrend is not reversed until neckline support is broken. Ideally, this should also occur in a convincing manner, with an expansion in volume

6. Once the support(neckline) is broken, it would now turn into the resistance level. Sometimes, but certainly not always, the price will return to the support break, and offer a second chance to sell.

7. Price target is projected by measuring the top of the head to the neckline. The distance is subtracted from the neckline to reach a price target. However, the price target should only serve as a rough guide. Other factors like previous support levels, Fibonacci retracements, or long-term moving averages should also be considered.

AGI Chart Analysis:

1. Check.

2. Check.

3. Check.

4. Check.

5. The two lows(green circles) are pointing at 11 as the neckline. Price breaking and closing below 11 would complete the pattern.

Initial target after breakdown: 9.04 (9)

Resistance after breaking down: 11

Will it break the support? RSI reading gives the clue on possible price movements in the short term.

*I used line chart to see the formation clearly although the pattern is also visible in the bar and candlestick charts.

It appears that a head and shoulder formation has formed on the weekly charts - which is very hard for me to ignore.

Book definition of head and shoulder pattern:

1. Needs a prior trend to reverse.

2. Left shoulder that marks the high point of the trend.

3. Head forms as a higher peak forms, exceeding the previous high. After peaking, the low of the subsequent decline marks the second point of the neckline. The low of the decline usually breaks the uptrend line, putting the uptrend in jeopardy.

4. Right shoulder forms as price advances from the low of the head which is lower than the head. The decline from the peak of the right shoulder should break the neckline.

5. Neckline forms by connecting the two lows.

Neckline break(most important part of the pattern): The pattern is not complete and the uptrend is not reversed until neckline support is broken. Ideally, this should also occur in a convincing manner, with an expansion in volume

6. Once the support(neckline) is broken, it would now turn into the resistance level. Sometimes, but certainly not always, the price will return to the support break, and offer a second chance to sell.

7. Price target is projected by measuring the top of the head to the neckline. The distance is subtracted from the neckline to reach a price target. However, the price target should only serve as a rough guide. Other factors like previous support levels, Fibonacci retracements, or long-term moving averages should also be considered.

AGI Chart Analysis:

1. Check.

2. Check.

3. Check.

4. Check.

5. The two lows(green circles) are pointing at 11 as the neckline. Price breaking and closing below 11 would complete the pattern.

Initial target after breakdown: 9.04 (9)

Resistance after breaking down: 11

Will it break the support? RSI reading gives the clue on possible price movements in the short term.

Tampons for the bleeding.

The selling eased out in today session, dropping lower by 33 points in comparison to yesterday's 76 point drop. It feels like we are going to find a higher low tomorrow.

The index looks like range trading from 4000-4200 levels. I think I just got my wish granted. Hopefully, index issues provide a significant range to trade.

NIKL, the current star of my portfolio, has finally broken out convincingly out of its previous high. It has also broke its psychological resistance at P20 and it is now trading at its all time high.

I put on additional position in NIKL today(+30% of my current position) and I am still not done putting up the whole position.

My position in APC has started to recover today and looks like there would be continuation. If P1 is taken out tomorrow, I believe it would be safe to assume that it will continue to advance further in the short term as suggested by RSI.

Positions in CYBR and ELI are both bleeding today. ELI tried to fill the gap today.

Buying opportunity on CYBR tomorrow(?).

My timing in my recent positions in APC, CYBR, and ELI is terrible. Position sizing is saving me though.

It feels like something is brewing in MER but still no guts to buy. I would probably trade it once it break 300.

SMC filled the small gap at 160-162 last December 28, 2010. Resistance at 189.

Range trade?

I'm going heavy on mining. There is this one mining issue that I have been monitoring secretly and looks like it is also going to break its most recent high. It is a highly despised stock but it is quietly trending up.

Are people still fearful or superman effect has started to surface?

*Buy at the closing on red days and sell on panic buying days on third liners?

The index looks like range trading from 4000-4200 levels. I think I just got my wish granted. Hopefully, index issues provide a significant range to trade.

NIKL, the current star of my portfolio, has finally broken out convincingly out of its previous high. It has also broke its psychological resistance at P20 and it is now trading at its all time high.

I put on additional position in NIKL today(+30% of my current position) and I am still not done putting up the whole position.

My position in APC has started to recover today and looks like there would be continuation. If P1 is taken out tomorrow, I believe it would be safe to assume that it will continue to advance further in the short term as suggested by RSI.

Positions in CYBR and ELI are both bleeding today. ELI tried to fill the gap today.

Buying opportunity on CYBR tomorrow(?).

My timing in my recent positions in APC, CYBR, and ELI is terrible. Position sizing is saving me though.

It feels like something is brewing in MER but still no guts to buy. I would probably trade it once it break 300.

SMC filled the small gap at 160-162 last December 28, 2010. Resistance at 189.

Range trade?

I'm going heavy on mining. There is this one mining issue that I have been monitoring secretly and looks like it is also going to break its most recent high. It is a highly despised stock but it is quietly trending up.

Are people still fearful or superman effect has started to surface?

*Buy at the closing on red days and sell on panic buying days on third liners?

Tuesday, January 18, 2011

Basura Plays Update

APC:

Formed a lower peak after a double top.

*Should have waited to break the double top before buying?

Possible support at 0.80.

Dark cloud cover candle on daily charts.

No RSI bearish divergence.

Normal correction.

ELI:

Formed a lower peak followed by an accelerated break down of the uptrend line.

*Should have waited for a sign of recovery before buying?

Possible Support at 0.70

Dark cloud cover on daily chart.

Bearish RSI divergence on the daily price.

SINO:

Formed a lower peak followed by accelerated decline but found(?) support at 0.43.

Buy if 0.45 is taken out.

Dark cloud cover candle on daily chart.

Bearish RSI divergence on the daily price.

*Note to self: Buy at the closing on red days and sell on panic buying days?

Formed a lower peak after a double top.

*Should have waited to break the double top before buying?

Possible support at 0.80.

Dark cloud cover candle on daily charts.

No RSI bearish divergence.

Normal correction.

ELI:

Formed a lower peak followed by an accelerated break down of the uptrend line.

*Should have waited for a sign of recovery before buying?

Possible Support at 0.70

Dark cloud cover on daily chart.

Bearish RSI divergence on the daily price.

SINO:

Formed a lower peak followed by accelerated decline but found(?) support at 0.43.

Buy if 0.45 is taken out.

Dark cloud cover candle on daily chart.

Bearish RSI divergence on the daily price.

*Note to self: Buy at the closing on red days and sell on panic buying days?

Stop the bleeding.

The market lost 75 points in today's trading. Major losers are led today MEG, MBT, MER and SM.

Bought APC and ELI today. Terrible timing I say as they both end up with paper losses. Good thing I only risked 1% on both position. Still doing it the wrong way. Anyway, I'm still going to try to learn how to trade them.

I closed my position in MBT at 64.40 at a loss. I closed my position in AGI at 12.02.

I thought I was seeing a falling method candlestick formation plus bearish RSI divergence in CYBR so I was really skeptical with it.

AP is looking to move sideways with downward bias(?).

Charts for the third line plays later as I am having trouble loading the charts. Let me see what I should have done.

Bought APC and ELI today. Terrible timing I say as they both end up with paper losses. Good thing I only risked 1% on both position. Still doing it the wrong way. Anyway, I'm still going to try to learn how to trade them.

I closed my position in MBT at 64.40 at a loss. I closed my position in AGI at 12.02.

I thought I was seeing a falling method candlestick formation plus bearish RSI divergence in CYBR so I was really skeptical with it.

AP is looking to move sideways with downward bias(?).

Charts for the third line plays later as I am having trouble loading the charts. Let me see what I should have done.

Monday, January 17, 2011

Aboitiz Power Corp. (AP)

This is the reason why I am still a little skeptical with AP:

Optimal buying window for AP is when it forms a higher trough.

Optimal buying window for AP is when it forms a higher trough.

Basura Plays

The main reason why I fail every time I buy third liners is because I don't know how to trade them properly. From the previous trades that I did, I would usually put up the same size of a position the same way I put in blues and second liners. I also put up the same stop loss point. With the erratic behavior of third liners, my stop always gets hit. I am out of the trade and then stock resumes its movement.

Now to solve my problem, I decided to put up a relative small position in third liners when trading with the same amount of capital at risk.

Position sizing is probably the answer to properly gamble on illiquid stocks.

*Word of caution: I am just trying out this idea and I have no idea if this will work. Please always do your own research before taking up positions. Caveat.

**Currently using the crudest form of technical analysis: Trend lines. No other technical indicator is being used as I find them highly unreliable when day/momentum trading. RSI and MACD bearish/bullish divergences doesn't seem to work in intraday charts as they would work on a daily chart.

(If you have better ideas on how to trade this kind of issues, please let me know, it will be greatly appreciated.)

Okay, moving on, using intraday charts to trade:

APC: Breaking out at .89 should be a buy.

ELI: Consolidating at its high. Range of consolidation is at 0.79 to 0.82.

Buy at 0.79. Buy on breakout(Resistance 0.82). Buy on pull back/bounce to/from resistance at 0.82.

SINO: Broke out of trading range 0.38-0.43. Currently heading for correction and looking to test 0.43. Buy the bounce from 0.43.

SUN: Possibly forming a symmetrical triangle. Buy at 0.58 for anticipation breakout.

Now to solve my problem, I decided to put up a relative small position in third liners when trading with the same amount of capital at risk.

Position sizing is probably the answer to properly gamble on illiquid stocks.

*Word of caution: I am just trying out this idea and I have no idea if this will work. Please always do your own research before taking up positions. Caveat.

**Currently using the crudest form of technical analysis: Trend lines. No other technical indicator is being used as I find them highly unreliable when day/momentum trading. RSI and MACD bearish/bullish divergences doesn't seem to work in intraday charts as they would work on a daily chart.

(If you have better ideas on how to trade this kind of issues, please let me know, it will be greatly appreciated.)

Okay, moving on, using intraday charts to trade:

APC: Breaking out at .89 should be a buy.

ELI: Consolidating at its high. Range of consolidation is at 0.79 to 0.82.

Buy at 0.79. Buy on breakout(Resistance 0.82). Buy on pull back/bounce to/from resistance at 0.82.

SINO: Broke out of trading range 0.38-0.43. Currently heading for correction and looking to test 0.43. Buy the bounce from 0.43.

SUN: Possibly forming a symmetrical triangle. Buy at 0.58 for anticipation breakout.

Skeptical/Neutral

Sold AP today for coffee money. Still being shaky with AP because I only bought it impulsively. Still wait for it to form a higher trough.

Currently holding AGI, CYBR, MBT and NIKL. I also sold several shares of MBT at 65.20 today because it's being a laggard and to raise funds for a possible trade for this week.

I am pretty much disappointed with the recent movement MBT. Good thing I sold some MBT at break-even as it continued to fall intraday before closing at its low. Right now, NIKL and MBT are cancelling each other out in my port! :))

I am skeptical with AGI's closing today but I still don't have a signal for profit taking. ROC is still poiting towards further advance in the short term.

I am also skeptical with my position in CYBR as I don't know how to trade it properly but since it is now showing profits, I will simply hold on to it in the mean time.

I am still neutral with NIKL as it simply continues to move sideways. ROC is now pointing up so this could probably point out to further advances in the short term.

Still trying to learn how to trade using intraday charts. Currently studying 5 minute charts for timing/day trading(in the future).

So in conclusion, I am still skeptical to neutral with my current positions.

Currently holding AGI, CYBR, MBT and NIKL. I also sold several shares of MBT at 65.20 today because it's being a laggard and to raise funds for a possible trade for this week.

I am pretty much disappointed with the recent movement MBT. Good thing I sold some MBT at break-even as it continued to fall intraday before closing at its low. Right now, NIKL and MBT are cancelling each other out in my port! :))

I am skeptical with AGI's closing today but I still don't have a signal for profit taking. ROC is still poiting towards further advance in the short term.

I am also skeptical with my position in CYBR as I don't know how to trade it properly but since it is now showing profits, I will simply hold on to it in the mean time.

I am still neutral with NIKL as it simply continues to move sideways. ROC is now pointing up so this could probably point out to further advances in the short term.

Still trying to learn how to trade using intraday charts. Currently studying 5 minute charts for timing/day trading(in the future).

So in conclusion, I am still skeptical to neutral with my current positions.

Sunday, January 16, 2011

Philippine Stock Exchange (PCOMP)

Looks like the market is poised to move sideways for the meantime after sliding down big time (as pointed out by the bearish rsi/price divergence) from the recent top at 4400 levels. However, the index seems to be moving higher this coming week as suggested by the strong closing last Friday with RSI seeking to break above 50.

Volume indicators reflect moderate flows of volume into the index indicates mild bullishness in the short to medium term.

Short to medium trend: Sideways to up.

Support: 4000 levels

Resistance: 4300 levels

Breaking and holding up above 4300 levels would suggest the resumption of the uptrend.

Friday, January 14, 2011

Blues clues

Finally! Funds are now flocking back to the blues! (They are the ones that I can read with some clarity) I actually lost money playing 3rd liners the first 2 weeks of January, same way I lost money when the foreigners decided to run the Index up from 3600 levels up to 4000+.

I bought AP today. I am looking to trade it for the mean time because I feel like I simply bought it impulsively. A higher trough would provide the best entry for going medium to long term.

Most of my open positions are going my way - AP, AGI, and MBT, while NIKL is showing commission loss. I also have a position in CYBR for speculating(walang kadala-dala) which is sticking like a sore pinkie also showing small loss - got in at 1.35.

I was somewhat disappointed MBT as it is still moving slowly after 3 days - AP yielded a higher gain than MBT intraday.

AGI is looking strong too although it is nearing its resistance levels already.

Holy pwet, I did not see, DMC got a 10MA penetration buy signal!

This weekend, I am looking forward to buying vodka to relieve this past week's stress! :))

Charts before the weekends!

I bought AP today. I am looking to trade it for the mean time because I feel like I simply bought it impulsively. A higher trough would provide the best entry for going medium to long term.

Most of my open positions are going my way - AP, AGI, and MBT, while NIKL is showing commission loss. I also have a position in CYBR for speculating(walang kadala-dala) which is sticking like a sore pinkie also showing small loss - got in at 1.35.

I was somewhat disappointed MBT as it is still moving slowly after 3 days - AP yielded a higher gain than MBT intraday.

AGI is looking strong too although it is nearing its resistance levels already.

Holy pwet, I did not see, DMC got a 10MA penetration buy signal!

This weekend, I am looking forward to buying vodka to relieve this past week's stress! :))

Charts before the weekends!

Thursday, January 13, 2011

Adding up positions

I added up positions in AGI and NIKL today because both stocks are behaving within expectations.

On the otherhand, MBT is still slightly below my entry although it is still behaving positively. ROC are pointing up suggesting price advances in the short term.

Sold ORE today for a 2% loss. It won't go up in basura days, it won't go up in blue and second liner days. It must be trading on a different market. The good thing about it is, my father won't be bugging me to buy this piece of crap anymore.

The proceeds of ORE are used to add up positions in AGI and NIKL.

AP recovered relatively stronger today however, I always find bullish harami candlesticks highly unreliable for buying/selling so I am still not betting on it. I'll buy again when it forms a higher trough.

I also bought SCC for my aunt today. It broke out of ascending triangle formation when it passed 200 with a short term target at 234.

I had 3 buy signals on SMC and still I did not buy.

I think I finally got the right word for ORE. Panis.

On the otherhand, MBT is still slightly below my entry although it is still behaving positively. ROC are pointing up suggesting price advances in the short term.

Sold ORE today for a 2% loss. It won't go up in basura days, it won't go up in blue and second liner days. It must be trading on a different market. The good thing about it is, my father won't be bugging me to buy this piece of crap anymore.

The proceeds of ORE are used to add up positions in AGI and NIKL.

AP recovered relatively stronger today however, I always find bullish harami candlesticks highly unreliable for buying/selling so I am still not betting on it. I'll buy again when it forms a higher trough.

I also bought SCC for my aunt today. It broke out of ascending triangle formation when it passed 200 with a short term target at 234.

I had 3 buy signals on SMC and still I did not buy.

I think I finally got the right word for ORE. Panis.

Wednesday, January 12, 2011

Richard Rhodes' Trading Rules

"Old Rules...but Very Good Rules"

If I've learned anything in my decades of trading, I've learned that the simple methods work best. Those who need to rely upon complex stochastics, linear weighted moving averages, smoothing techniques, Fibonacci numbers etc., usually find that they have so many things rolling around in their heads that they cannot make a rational decision. One technique says buy; another says sell. Another says sit tight while another says add to the trade. It sounds like a cliche, but simple methods work best.

1.

The first and most important rule is - in bull markets, one is supposed to be long. This may sound obvious, but how many of us have sold the first rally in every bull market, saying that the market has moved too far, too fast. I have before, and I suspect I'll do it again at some point in the future. Thus, we've not enjoyed the profits that should have accrued to us for our initial bullish outlook, but have actually lost money while being short. In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

2.

Buy that which is showing strength - sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied. This difference may not sound logical, but buying strength works. The rule of survival is not to "buy low, sell high", but to "buy higher and sell higher". Furthermore, when comparing various stocks within a group, buy only the strongest and sell the weakest.

3.

When putting on a trade, enter it as if it has the potential to be the biggest trade of the year. Don't enter a trade until it has been well thought out, a campaign has been devised for adding to the trade, and contingency plans set for exiting the trade.

4.

On minor corrections against the major trend, add to trades. In bull markets, add to the trade on minor corrections back into support levels. In bear markets, add on corrections into resistance. Use the 33-50% corrections level of the previous movement or the proper moving average as a first point in which to add.

5.

Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

6.

Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expected.

7.

Be patient. The old adage that "you never go broke taking a profit" is maybe the most worthless piece of advice ever given. Taking small profits is the surest way to ultimate loss I can think of, for small profits are never allowed to develop into enormous profits. The real money in trading is made from the one, two or three large trades that develop each year. You must develop the ability to patiently stay with winning trades to allow them to develop into that sort of trade.

8.

Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

9.

Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

10.

Never, ever under any condition, add to a losing trade, or "average" into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

11.

Do more of what is working for you, and less of what's not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, "let your profits run."

12.

Don't trade until the technicals and the fundamentals both agree. This rule makes pure technicians cringe. I don't care! I will not trade until I am sure that the simple technical rules I follow, and my fundamental analysis, are running in tandem. Then I can act with authority, and with certainty, and patiently sit tight.

13.

When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge "to get the money back" is extreme, and should not be given in to.

14.

When trading well, trade somewhat larger. We all experience those incredible periods of time when all of our trades are profitable. When that happens, trade aggressively and trade larger. We must make our proverbial "hay" when the sun does shine.

15.

When adding to a trade, add only 1/4 to 1/2 as much as currently held. That is, if you are holding 400 shares of a stock, at the next point at which to add, add no more than 100 or 200 shares. That moves the average price of your holdings less than half of the distance moved, thus allowing you to sit through 50% corrections without touching your average price.

16.

Think like a guerrilla warrior. We wish to fight on the side of the market that is winning, not wasting our time and capital on futile efforts to gain fame by buying the lows or selling the highs of some market movement. Our duty is to earn profits by fighting alongside the winning forces. If neither side is winning, then we don't need to fight at all.

17.

Markets form their tops in violence; markets form their lows in quiet conditions.

18.

The final 10% of the time of a bull run will usually encompass 50% or more of the price movement. Thus, the first 50% of the price movement will take 90% of the time and will require the most backing and filling and will be far more difficult to trade than the last 50%.

There is no "genius" in these rules. They are common sense and nothing else, but as Voltaire said, "Common sense is uncommon." Trading is a common-sense business. When we trade contrary to common sense, we will lose. Perhaps not always, but enormously and eventually. Trade simply. Avoid complex methodologies concerning obscure technical systems and trade according to the major trends only.

If I've learned anything in my decades of trading, I've learned that the simple methods work best. Those who need to rely upon complex stochastics, linear weighted moving averages, smoothing techniques, Fibonacci numbers etc., usually find that they have so many things rolling around in their heads that they cannot make a rational decision. One technique says buy; another says sell. Another says sit tight while another says add to the trade. It sounds like a cliche, but simple methods work best.

1.

The first and most important rule is - in bull markets, one is supposed to be long. This may sound obvious, but how many of us have sold the first rally in every bull market, saying that the market has moved too far, too fast. I have before, and I suspect I'll do it again at some point in the future. Thus, we've not enjoyed the profits that should have accrued to us for our initial bullish outlook, but have actually lost money while being short. In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

2.

Buy that which is showing strength - sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied. This difference may not sound logical, but buying strength works. The rule of survival is not to "buy low, sell high", but to "buy higher and sell higher". Furthermore, when comparing various stocks within a group, buy only the strongest and sell the weakest.

3.

When putting on a trade, enter it as if it has the potential to be the biggest trade of the year. Don't enter a trade until it has been well thought out, a campaign has been devised for adding to the trade, and contingency plans set for exiting the trade.

4.

On minor corrections against the major trend, add to trades. In bull markets, add to the trade on minor corrections back into support levels. In bear markets, add on corrections into resistance. Use the 33-50% corrections level of the previous movement or the proper moving average as a first point in which to add.

5.

Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

6.

Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expected.

7.

Be patient. The old adage that "you never go broke taking a profit" is maybe the most worthless piece of advice ever given. Taking small profits is the surest way to ultimate loss I can think of, for small profits are never allowed to develop into enormous profits. The real money in trading is made from the one, two or three large trades that develop each year. You must develop the ability to patiently stay with winning trades to allow them to develop into that sort of trade.

8.

Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

9.

Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

10.

Never, ever under any condition, add to a losing trade, or "average" into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

11.

Do more of what is working for you, and less of what's not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, "let your profits run."

12.

Don't trade until the technicals and the fundamentals both agree. This rule makes pure technicians cringe. I don't care! I will not trade until I am sure that the simple technical rules I follow, and my fundamental analysis, are running in tandem. Then I can act with authority, and with certainty, and patiently sit tight.

13.

When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge "to get the money back" is extreme, and should not be given in to.

14.

When trading well, trade somewhat larger. We all experience those incredible periods of time when all of our trades are profitable. When that happens, trade aggressively and trade larger. We must make our proverbial "hay" when the sun does shine.

15.

When adding to a trade, add only 1/4 to 1/2 as much as currently held. That is, if you are holding 400 shares of a stock, at the next point at which to add, add no more than 100 or 200 shares. That moves the average price of your holdings less than half of the distance moved, thus allowing you to sit through 50% corrections without touching your average price.

16.

Think like a guerrilla warrior. We wish to fight on the side of the market that is winning, not wasting our time and capital on futile efforts to gain fame by buying the lows or selling the highs of some market movement. Our duty is to earn profits by fighting alongside the winning forces. If neither side is winning, then we don't need to fight at all.

17.

Markets form their tops in violence; markets form their lows in quiet conditions.

18.

The final 10% of the time of a bull run will usually encompass 50% or more of the price movement. Thus, the first 50% of the price movement will take 90% of the time and will require the most backing and filling and will be far more difficult to trade than the last 50%.

There is no "genius" in these rules. They are common sense and nothing else, but as Voltaire said, "Common sense is uncommon." Trading is a common-sense business. When we trade contrary to common sense, we will lose. Perhaps not always, but enormously and eventually. Trade simply. Avoid complex methodologies concerning obscure technical systems and trade according to the major trends only.

I am running out of adjectives

MER advanced strongly today, making a gap at the opening and closing the gap at 280 levels and now fast approaching its all time high. It made a gap up today so I didn't buy.

On the otherhand, AP continued to decline today bleeding badly and losing another 5%. The reason of the decline? Nothing in particular. Immediate support is pegged at its 130-MA at 25.

The reason why MER is climbing up strongly is because they are going to go into the power generation business. The funny thing about it is, AP is already in the said sector and already generating power. The market is never really logical.

AGI did what I was expecting to do so I completed my buying today.

Bought MBT thinking that it is already oversold but I think I got in a little earlier as it dropped further at the closing.

Bought NIKL when it broke 19.

I am running out of adjectives for ORE.

LC gave off a short term buy signal today.

On the otherhand, AP continued to decline today bleeding badly and losing another 5%. The reason of the decline? Nothing in particular. Immediate support is pegged at its 130-MA at 25.

The reason why MER is climbing up strongly is because they are going to go into the power generation business. The funny thing about it is, AP is already in the said sector and already generating power. The market is never really logical.

AGI did what I was expecting to do so I completed my buying today.

Bought MBT thinking that it is already oversold but I think I got in a little earlier as it dropped further at the closing.

Bought NIKL when it broke 19.

I am running out of adjectives for ORE.

LC gave off a short term buy signal today.

Tuesday, January 11, 2011

Philippine Stock Exchange Index (PCOMP)

PSEi 10-Year Daily Chart

The PSEi broke its major support line today. Is this the beginning of the end? It would seem not as the MACD are forming several rising troughs. The breaking of the said trendline only suggests that the market is slowing down to a more sustainable trend. With this being said, the market would simply move sideways for the meantime before heading back up again.

Breaking the secondary trendline would suggest further slowdown of the market.

Breaking down from the major support at 3870 levels would only suggest a deep correction(very deep in fact as it is pointing to 3500-3600 levels if it is an accelerated decline).

Market Condition: Sideways to down.

The PSEi broke its major support line today. Is this the beginning of the end? It would seem not as the MACD are forming several rising troughs. The breaking of the said trendline only suggests that the market is slowing down to a more sustainable trend. With this being said, the market would simply move sideways for the meantime before heading back up again.

Breaking the secondary trendline would suggest further slowdown of the market.

Breaking down from the major support at 3870 levels would only suggest a deep correction(very deep in fact as it is pointing to 3500-3600 levels if it is an accelerated decline).

Market Condition: Sideways to down.

Taking hits!

The market lost another 80.21 points today after meeting resistance at 4200 levels. I thought it was the lack of leads is what causing the landslide but apparently, it was the "poor" job data and debt problems in Europe. Pretty much old news to cause this drop. I'm more inclined to say that the recent drop is exaggerated. Anyway, I think it would be safe to assume that the short term support for the index is at the previous low of 3950.

Today, I sold all my remaining position in AP as every system that I used to trade it before told me to close it. I'll be waiting for it to form a higher through or an exceptionally bullish reversal pattern before getting in again. I wonder what did the guys that bought alot of AP at 32.80 do.

ORE is pretty much boring though. I am expecting it to move within 2 to 4 days.

I am simply waiting for my trade setups to take full form in NIKL, SMC, MBT and MPI in this particular order. By the way, COL already included NIKL in their marginable stocks.

BEL has started to correct too although I am not eager to buy it because of its long candle wicks although the bearish RSI divergence has been negated already.

MER gave a buy signal today. My buying wasn't hit at the closing so I will try to buy tomorrow at the opening if it doesn't gap.

Bought a few AGI today for range trading. I am going to complete my buying tomorrow if momentum confirms it.

I think I will drop JGS from my "oversold and recovering watch list" and I would focus my attention on URC. They bought back 800k shares at 34.95 at the market.

Judging the behavior of the index, looks like the market is going to trend up slowly again which I like better rather than them surging up like crazy.

Today, I sold all my remaining position in AP as every system that I used to trade it before told me to close it. I'll be waiting for it to form a higher through or an exceptionally bullish reversal pattern before getting in again. I wonder what did the guys that bought alot of AP at 32.80 do.

ORE is pretty much boring though. I am expecting it to move within 2 to 4 days.

I am simply waiting for my trade setups to take full form in NIKL, SMC, MBT and MPI in this particular order. By the way, COL already included NIKL in their marginable stocks.

BEL has started to correct too although I am not eager to buy it because of its long candle wicks although the bearish RSI divergence has been negated already.

MER gave a buy signal today. My buying wasn't hit at the closing so I will try to buy tomorrow at the opening if it doesn't gap.

Bought a few AGI today for range trading. I am going to complete my buying tomorrow if momentum confirms it.

I think I will drop JGS from my "oversold and recovering watch list" and I would focus my attention on URC. They bought back 800k shares at 34.95 at the market.

Judging the behavior of the index, looks like the market is going to trend up slowly again which I like better rather than them surging up like crazy.

Monday, January 10, 2011

Way to kick off the week!~

Wow landslide! The index lost 89.94 points today. Majority of the issues today are simply free falling. I am assuming that the lack of lead is the cause of this free fall. Anyway, it is still basura plays which I don't know how to trade so I am simply holding current positions.

Ap went into a steep decline today and it is still within short term downtrend. Should it close at 31.50 or higher would suggest the end of the down trend. During the weekend, I was hoping that AP would open on its low. Well, my wish was granted and more! A bounce from 28.50 should provide a good entry.

Terrible timing with ORE but prices are currently still holding up above my stops.

There are only handful of stocks in my watchlist that are still holding up. BEL, MBT, MER, MPI, mining stocks(ORE, PX, AT, LC, NIKL), SMC and PCOR.

AGI looks nice for range trading. Support is at 11 levels and resistance at 12.50-13 levels.

DMC looks good for a breakout play although it is still moving sideways within a very tight channel.

JGS and URC are still on the reversal/oversold playlist.

Stocks that are on the top of my list are MBT, NIKL, and SMC.

Stay with strength!

Ap went into a steep decline today and it is still within short term downtrend. Should it close at 31.50 or higher would suggest the end of the down trend. During the weekend, I was hoping that AP would open on its low. Well, my wish was granted and more! A bounce from 28.50 should provide a good entry.

Terrible timing with ORE but prices are currently still holding up above my stops.

There are only handful of stocks in my watchlist that are still holding up. BEL, MBT, MER, MPI, mining stocks(ORE, PX, AT, LC, NIKL), SMC and PCOR.

AGI looks nice for range trading. Support is at 11 levels and resistance at 12.50-13 levels.

DMC looks good for a breakout play although it is still moving sideways within a very tight channel.

JGS and URC are still on the reversal/oversold playlist.

Stocks that are on the top of my list are MBT, NIKL, and SMC.

Stay with strength!

Friday, January 7, 2011

No more momentum trading.

Nothing much happened to me in today's trading, except getting whipsawed in CYBR. 1% gain vs 24% gain in 1 day differential. Wow, I really suck at this. Day/Momentum trading feels like I'm buying impulsively. Going back to my usual trading.

Congrats to those who can profit from day trading!~

Anyway, I am positive that mining would start moving by next week(including my position in ORE as its ROC just got positive today). I'm going to let it hit my stop.

AP done with the final accelerated intraday drop today? I hope so, so it could finally start moving back up again.

I'm going to look for possible trades once I exit ORE(alive) this weekend. I am also going to test a lot of things on Metastock as I have finally got the data I needed(backing up to 1999).

Looks like its going to be a busy weekend.

Congrats to those who can profit from day trading!~

Anyway, I am positive that mining would start moving by next week(including my position in ORE as its ROC just got positive today). I'm going to let it hit my stop.

AP done with the final accelerated intraday drop today? I hope so, so it could finally start moving back up again.

I'm going to look for possible trades once I exit ORE(alive) this weekend. I am also going to test a lot of things on Metastock as I have finally got the data I needed(backing up to 1999).

Looks like its going to be a busy weekend.

Thursday, January 6, 2011

"Long term investor"

Sold CYBR for 1.36% profit! I was being greedy and stupid thinking that it will still climb higher right after the opening. I suck at day trading! I'll try to test it this month. If I don't get better at this, I would simply stick to short to medium term trading instead.

Bought ORE today at 3.85. I thought it would close higher before getting sold down at the last minute! I already bought at the last 30 minutes of trading and still end up with paper loss? I might be handing my money to JAP! Just kidding. I checked the previous transactions of ORE this week starting from Jan 3 and I found out that JAP(broker) is still holding around a million or so shares. Looking at last month's war chest, JAP is holding around 30 millions shares or so. From the looks of it, I am going to be a "long term investor" in here as they still have 30 million shares to sell! Haha!

My only consolation for keeping my negative position here in ORE is, it is poised to go up as suggested by the increasing(slight) ROC. Should have put my bet NIKL for the mining play. Anyway, what done is done and I am simply going to let it hit my stop before getting out.

AP closing above 32 would suggest the start of the uptrend. Bounce from 30 already~

Oh, and did anyone notice that the same amount of shares that was bought up yesterday in PA was also sold today? That's alot of "investors" right there!

*Metastock update: I tried to use the downloadable data from COL's website. Unfortunately, most of the files have "bad date" rendering some of metastock's feature useless. Anyway, I'll try to get the data using PSEGET today.

*As I was checking the monthly warchest starting from November, I found out that in November and December, A&A Securities have been buying(no selling done). Who could A&A Sec be? Sure they have lesser amount of shares than JAP but they never sell(except this week as they sold 30k shares).

Bought ORE today at 3.85. I thought it would close higher before getting sold down at the last minute! I already bought at the last 30 minutes of trading and still end up with paper loss? I might be handing my money to JAP! Just kidding. I checked the previous transactions of ORE this week starting from Jan 3 and I found out that JAP(broker) is still holding around a million or so shares. Looking at last month's war chest, JAP is holding around 30 millions shares or so. From the looks of it, I am going to be a "long term investor" in here as they still have 30 million shares to sell! Haha!

My only consolation for keeping my negative position here in ORE is, it is poised to go up as suggested by the increasing(slight) ROC. Should have put my bet NIKL for the mining play. Anyway, what done is done and I am simply going to let it hit my stop before getting out.

AP closing above 32 would suggest the start of the uptrend. Bounce from 30 already~

Oh, and did anyone notice that the same amount of shares that was bought up yesterday in PA was also sold today? That's alot of "investors" right there!

*Metastock update: I tried to use the downloadable data from COL's website. Unfortunately, most of the files have "bad date" rendering some of metastock's feature useless. Anyway, I'll try to get the data using PSEGET today.

*As I was checking the monthly warchest starting from November, I found out that in November and December, A&A Securities have been buying(no selling done). Who could A&A Sec be? Sure they have lesser amount of shares than JAP but they never sell(except this week as they sold 30k shares).

Wednesday, January 5, 2011

Universal Robina Corporation (URC)

URC 3-YR Daily Chart

URC seems like nearing/at the bottom already as there has been a bullish MACD divergence on the daily charts.

If the bands constrict at 34 levels, a breakout from that level would suggest the reversal of the intermediate trend.

Watch it, no need to rush to get in as it might still slide further.

URC seems like nearing/at the bottom already as there has been a bullish MACD divergence on the daily charts.

If the bands constrict at 34 levels, a breakout from that level would suggest the reversal of the intermediate trend.

Watch it, no need to rush to get in as it might still slide further.

Metastock!

I finally got myself Metastock! Yay! I am psyched! Anyway, I have been tinkering with it last night and I find some useful stuff like scanning the entire market with your own trading conditions, etc etc. Unfortunately, I only have 6 months worth of data to backtest the trading systems that are included in the application so that's a little let down. Anyway, I am trying to figure out how to get and convert the downloadable data from citisec.

Thanks to Sir Jax (from FM) a.k.a. Mr. Jun Ignacio. You can visit his website at http://funnymentals.uphero.com. If you need help to systematize your trading, you can avail his services through the website! Many thanks again sir Jax!

Got to go and play with Metastock!~

*AP is looking to head down to 30.50 before bouncing back up! I am basing on intraday speed resistance lines. It has broke down from 2 speed resistance lines so it is now heading for a quick intraday drop!

Thanks to Sir Jax (from FM) a.k.a. Mr. Jun Ignacio. You can visit his website at http://funnymentals.uphero.com. If you need help to systematize your trading, you can avail his services through the website! Many thanks again sir Jax!

Got to go and play with Metastock!~

*AP is looking to head down to 30.50 before bouncing back up! I am basing on intraday speed resistance lines. It has broke down from 2 speed resistance lines so it is now heading for a quick intraday drop!

Sucker game in play?

I was choosing between CYBR and LND today and I decided to buy CYBR at 0.81 at the closing with my available funds today as it seems to have stronger momentum. Hopefully it goes well tomorrow.

LND formed a bullish engulfing which provides a good signal for short term trading. However, it is relatively at the top of its trading range which I feel much risky than the momentum setup in CYBR.

I missed PA too as there's no way for me to buy it(well I was trying to figure out ways to trade this type of issue). Buying PA at the closing is probably the best method to take position in this type of issue - plus the fact that it was illiquid for the past year - no way for me to catch a trade like this.

Hopefully, I could get out alive with CYBR just in time for MER/MPI/SMC/LC.