Disclaimer: The content posted in this blog is for informational purposes only and it should not be taken as an endorsement or solicitation to buy/sell the aforementioned issues. The information posted here is obtained through personal research and analysis, reserving the right to change them anytime. Investing in the money markets is accompanied by substantial risks to one's capital.

Thursday, June 2, 2011

Chasing momentum

Sold 25% of LPZ position @ 6.54 for a mere 1% profit.

Sold all URC for commision loss + 0.4% loss.

Proceeds from both position were used to buy back PX. Calculated breakout entry is 21.15.

LPZ was pushed up at the closing, giving my position some superficial gain.

LC closed on high. Second day after breaking out.

LCB broke past 1 already.

Breakout buy seems to be working pretty nice.

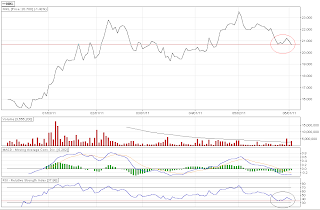

"Buy stop",(calculated from last month's MPP,)for MER @257 was "hit" today. Unfortunately, I wasn't really watching it. It looks good now nonetheless as volatility and trading range is above average.

I was scanning the market last night for possible trades using RMO.

It gave buy "above-high" signals for Industrial and Mining-O indexes.

Same signals were found in LC and PX. On the other hand, I was thinking what possible play from the Industrial index. It never came to me that MER is under the Industrial index. Stupid me.

The All-shares index was also given by the system a buy-above-high signal.

A broad-base rally perhaps?

By the way, I heard that the US and EUR markets broke pretty bad last night.

Sold all URC for commision loss + 0.4% loss.

Proceeds from both position were used to buy back PX. Calculated breakout entry is 21.15.

LPZ was pushed up at the closing, giving my position some superficial gain.

LC closed on high. Second day after breaking out.

LCB broke past 1 already.

Breakout buy seems to be working pretty nice.

"Buy stop",(calculated from last month's MPP,)for MER @257 was "hit" today. Unfortunately, I wasn't really watching it. It looks good now nonetheless as volatility and trading range is above average.

I was scanning the market last night for possible trades using RMO.

It gave buy "above-high" signals for Industrial and Mining-O indexes.

Same signals were found in LC and PX. On the other hand, I was thinking what possible play from the Industrial index. It never came to me that MER is under the Industrial index. Stupid me.

The All-shares index was also given by the system a buy-above-high signal.

A broad-base rally perhaps?

By the way, I heard that the US and EUR markets broke pretty bad last night.