Besides the fact that the index got severely murdered in today's trading, nothing much happened in today's session. The index wasn't spared from the turmoil overseas(Egypt), closing 2.24% lower from yesterday. As of writing, Asian markets are down by more than 1% so that still makes us the biggest loser, second to NASDAQ's drop last Friday at -2.48%.

The drop was led by TEL -0.73%, AP -5.29%, MER -6.93%, BPI -4.98%, AC -5.29%,

SM -3.89%, AGI -2.71%, and MBT -2.55%.

Panic selling was seen everywhere. My core stock - NIKL - experienced its heaviest drop today, dropping to 19 before closing 19.54, 4.68% lower from yesterday.

The drop today left huge gaps at (20.50 and 20.10) and (19.90 and 19.70) visible on the 5-minute candlestick chart.

I am expecting the gap at 19.90-19.70 to be filled in the next few days but I am having doubts that the gap at 19.90 will be filled immediately.

I put up another small position at 19.44 today.

SCC is very heavy, closing almost unchanged at 198.90 - my original entry. I am hoping that it rebounds in the short term as Oil is starting to move up again.

It looks like it's forming a symmetrical triangle on the daily chart.

Yikes with LC. Timing of entry is a little off but the stock is moving within expectations. Rising method candle pattern on the weekly chart.

I couldn't make anything out of SMC so I wont be touching it in the short term or until it fills the gap.

AP seems to be forming a symmetrical triangle pattern(bearish) on the daily chart.

I am patiently waiting for AGI.

The game has definitely changed. Dead cats, anyone?

Disclaimer: The content posted in this blog is for informational purposes only and it should not be taken as an endorsement or solicitation to buy/sell the aforementioned issues. The information posted here is obtained through personal research and analysis, reserving the right to change them anytime. Investing in the money markets is accompanied by substantial risks to one's capital.

Monday, January 31, 2011

Friday, January 28, 2011

Trading plan

Here is the trading plan that I made for this past week:

I never took position in MEG but in SMC instead.

Avoid/Sell holding and industrial stocks.

Buy financial and property stocks for oversold/technical bounce play.

Buy mining stocks for bucking the short/medium term downtrend but be extra careful.

Check for bearish rsi divergences to spot weakness as weakness has already starting to surface.

Take positions in leaders.

MEG in property sector.

NIKL/LC/SCC in mining sector.

General market short to medium term trend is down.

I never took position in MEG but in SMC instead.

I told you so.

I was judging SMC strength the entire time today on to whether I would sell it or not by watching the price action and the 5-minute chart. There seemed little appetite for shares above 178 so I sold mine to lock in profits.

Although there were only few shares asked at 176.50, nobody wanted to take it and everybody was just waiting at 176. This is after I already sold my shares to the market. Then it was bid up at the closing back to 178. But the charts never lie, and I saw a symmetrical triangle on the 5 minute chart breaking down suggesting further decline to 169.50. RSI on the 5-minute chart looks pretty ugly too so I am just simply waiting for it to get oversold before getting back in.

I probably should not add up positions after they gap as I should be looking to "fade" the gap instead.

NIKL seems like it is poised for another correction, probably up to 20.30 before heading back up. 5-minute uptrend line is holding up so far.

A bearish RSI divergence appeared on the daily charts though. However, the divergence happened below the oversold levels so I'll be taking it as a normal correction for the mean time.

SCC just moved sideways today. A convincing break of 203 will point to advance/s in the short term. What I hate with the stock is its ROC is pointing up while its price is simply stagnating at the current levels.

I put up a position in LC today at the closing.

MA and MAB broke out of their consolidation channel. MA closed at its resistance which I believe will not be broken as the RSI reading is already on the overbought levels. The main problem of this kind of issues is they are highly illiquid meaning minimal public participation rendering technical analysis useless as the analysis is used to gauge/predict herd mentality.

It's going to be a different story if both starts to trend up again.

I hate to say this but I told you so. Somebody is shooting his foot in AGI - talking about the short term.

So there. Ending up the week with mining stocks and recovering costly mistakes by playing with the third liners.

**I was also became anxious of closing "weak" positions as my Uncle called me to buy BEL and LND. Somebody who doesn't know how to trade is telling me how to trade. How ironic. Guess what happened to both issues?

Although there were only few shares asked at 176.50, nobody wanted to take it and everybody was just waiting at 176. This is after I already sold my shares to the market. Then it was bid up at the closing back to 178. But the charts never lie, and I saw a symmetrical triangle on the 5 minute chart breaking down suggesting further decline to 169.50. RSI on the 5-minute chart looks pretty ugly too so I am just simply waiting for it to get oversold before getting back in.

I probably should not add up positions after they gap as I should be looking to "fade" the gap instead.

NIKL seems like it is poised for another correction, probably up to 20.30 before heading back up. 5-minute uptrend line is holding up so far.

A bearish RSI divergence appeared on the daily charts though. However, the divergence happened below the oversold levels so I'll be taking it as a normal correction for the mean time.

SCC just moved sideways today. A convincing break of 203 will point to advance/s in the short term. What I hate with the stock is its ROC is pointing up while its price is simply stagnating at the current levels.

I put up a position in LC today at the closing.

MA and MAB broke out of their consolidation channel. MA closed at its resistance which I believe will not be broken as the RSI reading is already on the overbought levels. The main problem of this kind of issues is they are highly illiquid meaning minimal public participation rendering technical analysis useless as the analysis is used to gauge/predict herd mentality.

It's going to be a different story if both starts to trend up again.

I hate to say this but I told you so. Somebody is shooting his foot in AGI - talking about the short term.

So there. Ending up the week with mining stocks and recovering costly mistakes by playing with the third liners.

**I was also became anxious of closing "weak" positions as my Uncle called me to buy BEL and LND. Somebody who doesn't know how to trade is telling me how to trade. How ironic. Guess what happened to both issues?

Thursday, January 27, 2011

Breaking free.

Well, what do you know. SMC shoot right up today because of the news of the offering will not be postponed and now priced at 200-250. Coincidentally, the gap today points to 211 as a target in the short term so I'll be keeping this one for a while. I also increased my position today.

I put up a position in SCC today at the closing.

NIKL showed alot of hot love today, peaking at 21.20 before closing at 20.90, also filling the intraday gap(5-minute)at 20.80. Data on my previous analysis of the chart is updated 'cept for the chart.

SOLD APC for a loss today.

SOLD AGI at 11.96. I was being stupid and greedy that it will push higher into mid-12s today while my analysis is just pointing at 11.98 so I sold a fluctuation lower.

ATR was very active in this stock today but I don't think I am willing to bet on them yet. There was also a huge cross by UBS. I am skeptical with this cross sale as I feel like cross sales at the top end of the range is distribution. Or maybe I am simply being paranoid.

Still holding ELI. What a sucky position. I want to break free.

The index might meet resistance at 4090 in the short term so that leaves us with 2% gain in one day(doubt it) or 1% gain in 2 days which would mean that the resistance will be met by Monday.

*Heavily monitoring the Index as I am only comfortable trading index issues.

***I just got the daily quotation report and have I read it right? Around 1B NFB?!

I put up a position in SCC today at the closing.

NIKL showed alot of hot love today, peaking at 21.20 before closing at 20.90, also filling the intraday gap(5-minute)at 20.80. Data on my previous analysis of the chart is updated 'cept for the chart.

SOLD APC for a loss today.

SOLD AGI at 11.96. I was being stupid and greedy that it will push higher into mid-12s today while my analysis is just pointing at 11.98 so I sold a fluctuation lower.

ATR was very active in this stock today but I don't think I am willing to bet on them yet. There was also a huge cross by UBS. I am skeptical with this cross sale as I feel like cross sales at the top end of the range is distribution. Or maybe I am simply being paranoid.

Still holding ELI. What a sucky position. I want to break free.

The index might meet resistance at 4090 in the short term so that leaves us with 2% gain in one day(doubt it) or 1% gain in 2 days which would mean that the resistance will be met by Monday.

*Heavily monitoring the Index as I am only comfortable trading index issues.

***I just got the daily quotation report and have I read it right? Around 1B NFB?!

Risk-Reward of closed trades

Updated on every closed trades

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0

Closed trades:

1/05-1/06 CYBR 1:0.61

1/11-1/17 AGI 1:3.5

1/12-1/20 CYBR 1:0

1/20-1/27 AGI 1:3.5

1/17-1/27 APC 1:0

1/27-1/28 SMC 1:2

1/18-1/28 ELI 2:0

1/27-2/02 SCC 0.1:0

1/28-2/02 LC 1:0

2/01-2/02 MER 1:0.1

2/02-2/11 SMC 1:0

2/08-2/11 AGI 0.76:0

2/07-2/14 AGI 0.24:0

Open position/s:

1/12/11 NIKL 1:0

Wednesday, January 26, 2011

Sucker market.

What a sucker market. Good thing the bombing yesterday didn't have much effect in today's trading.

I feel like somebody is going to shoot his own foot in AGI this week. He started shooting when locals started to buy it up to 11.80. I was looking at the 5 minute chart and the gap at 11.80 has been filled already. Next gap is at 11.94.

There was a tug of war in NIKL at 19.98. Looks like the bulls won - for now.

LND sure does look interesting.

LC is already at its uptrend support line. Expect to test 0.561 in the short term.

Changing trading strategy to properly suit up this kind of market.

I feel like somebody is going to shoot his own foot in AGI this week. He started shooting when locals started to buy it up to 11.80. I was looking at the 5 minute chart and the gap at 11.80 has been filled already. Next gap is at 11.94.

There was a tug of war in NIKL at 19.98. Looks like the bulls won - for now.

LND sure does look interesting.

LC is already at its uptrend support line. Expect to test 0.561 in the short term.

Changing trading strategy to properly suit up this kind of market.

Tuesday, January 25, 2011

Start of the emotional rally?

Looks like the market just started its recovery. It feels like an emotional rally after 5 days of heavy bleeding. I am expecting immediate resistance at 4200 levels.

Every position in my portfolio started to recover today as well. AGI is the only one acting retarded in this strong market. Annoying little bugger. Sell on rally. Formed another doji today. Possibly gathering enough strength to challenge 12 again.

APC is got bid up again today with 10M shares. Although it has closed unchanged(doji) today, with this market you'll never know so I'll be selling on rally and take some money off the basura table.

MEG is showed a strong recovery today. Too bad I didn't have the balls to catch some falling knives yesterday. It could go up to 2.40 and 2.60 at most in the short term.

JGS started its reversal today. Will buy on higher trough formation.

Bought SMC at the closing and looking to range trade. Will continue to hold if it breaks 180.

Every position in my portfolio started to recover today as well. AGI is the only one acting retarded in this strong market. Annoying little bugger. Sell on rally. Formed another doji today. Possibly gathering enough strength to challenge 12 again.

APC is got bid up again today with 10M shares. Although it has closed unchanged(doji) today, with this market you'll never know so I'll be selling on rally and take some money off the basura table.

MEG is showed a strong recovery today. Too bad I didn't have the balls to catch some falling knives yesterday. It could go up to 2.40 and 2.60 at most in the short term.

JGS started its reversal today. Will buy on higher trough formation.

Bought SMC at the closing and looking to range trade. Will continue to hold if it breaks 180.

Monday, January 24, 2011

Penetration of 3896: Spring or sign of impending doom?

The index is hanging by a thread already from the support at 3896 which was also penetrated in today's session. Luckily, the market slightly recover at the end of the session closing at 3902. From the looks of it, we just entered the oversold levels.

Note: Oversold levels can remain oversold on a downtrend and vice versa.

"Good news" from the overseas doesn't seem to have effect on our market. The drop is probably about inflation.

There were hardly notable gainers for today except LPZ gaining 4.4% MER with 3.42% and SMPH with 2.50%, completely bucking the trend. Major losers today are the previous week's third line gainers.

Well today I simply sat tight and watched the ticker as panic selling ensues at the opening, recovering slightly by mid session and closing lower by the closing.

AGI closed unchanged today, forming a doji on the lower end of its trading channel which I am assuming that the candlestick is bullish as it is also accompanied by low volume(selling pressure is easing out).

There were crosses at the closing by CLSA. ATR chumped on a huge volume at around starting at 11.12.

NIKL might continue to correct in the short term as suggested by decreasing ROC. A bounce from 50 RSI levels is probably a good entry.

The third line issues did what I was expecting them to do(to disappoint) so

I am just waiting for the stops to be hit. Or sell on rallies.

I made a trading plan on CPM, PAX, MEG, and T over the weekend. Everything are going withing expectations but I decided not to execute the plan and put on additional positions at risk until I get out of the weak positions on the third line issues.

Note: Oversold levels can remain oversold on a downtrend and vice versa.

"Good news" from the overseas doesn't seem to have effect on our market. The drop is probably about inflation.

There were hardly notable gainers for today except LPZ gaining 4.4% MER with 3.42% and SMPH with 2.50%, completely bucking the trend. Major losers today are the previous week's third line gainers.

Well today I simply sat tight and watched the ticker as panic selling ensues at the opening, recovering slightly by mid session and closing lower by the closing.

AGI closed unchanged today, forming a doji on the lower end of its trading channel which I am assuming that the candlestick is bullish as it is also accompanied by low volume(selling pressure is easing out).

There were crosses at the closing by CLSA. ATR chumped on a huge volume at around starting at 11.12.

NIKL might continue to correct in the short term as suggested by decreasing ROC. A bounce from 50 RSI levels is probably a good entry.

The third line issues did what I was expecting them to do(to disappoint) so

I am just waiting for the stops to be hit. Or sell on rallies.

I made a trading plan on CPM, PAX, MEG, and T over the weekend. Everything are going withing expectations but I decided not to execute the plan and put on additional positions at risk until I get out of the weak positions on the third line issues.

PSEi: Doomsday scenario

As the moons of Mars and Earth align, just kidding.

Possible scenario for PSEi if it completely breaks down from support:

Possible scenario for PSEi if it completely breaks down from support:

Fire burning on the dance floor

Everybody is running towards the nearest exit.

Previous all time high at 3896 is broken. Next is 3820. Doomsday scenario is happening?

Previous all time high at 3896 is broken. Next is 3820. Doomsday scenario is happening?

Friday, January 21, 2011

Yikes!

Alot of bearish RSI divergences on the weekly charts. PSEi breakdown from support.

Hold your breathe and take the dive at 3800~

Hold your breathe and take the dive at 3800~

Sideways to down.

The PSEi did took the center stage as it lost another 1.38% in today's session, beating western and asian markets with the exception of FTSE. The index has also formed a new lower high and lower low in the short term and it has also broken below the previous low of 3953 - 2 points lower. The market might continue to move sideways in the intermediate term with a downward bias.

It's been a long time since I went red. Yikes.

Got faked out in APC because of the 23M bid at yesterday's closing. It has formed formed bearish candlesticks this week - Falling method followed by a bearish engulfing pattern. However, weekly chart is telling other wise - a long white candlestick and MACD buy signal so the weakness in the daily chart is probably a buy. For the past year, its weekly MACD buy signal works so I am still giving APC a week or two.

Also got faked in AGI. Weekly and daily chart looks very ugly. Should have taken whatever money it gave this week.

ELI started its recovery today. Spinning top after a decline would suggest sellers are losing control. ROC has also started to turn up so I am guessing it's about to advance in the short term. Weekly candlestick is showing a large doji which is bearish. Hopefully it opens higher this week.

NIKL is probably on correction mode.

Waiting for SCC to bounce before getting in. It seems like its going to consolidate in the short term within +/- 200 range.

AP seems to be forming a symmetrical triangle pattern(?). Also forming three stars in the south candle formations and RSI is back on its old support(39.59). Daily signs are mixed so I am not willing to bet on it yet.

Probably best to wait for:

1. Higher high (since it seems like to have formed a higher low already).

2. RSI bounce from 52 in the weekly chart.

All of the stocks that I am currently holding seems to have a normal bid/ask at the closing except NIKL which has 200k shares at 19.98.

RSI buy signal does seem to work on a 5-minute chart if the stock is range trading.

It's been a long time since I went red. Yikes.

Got faked out in APC because of the 23M bid at yesterday's closing. It has formed formed bearish candlesticks this week - Falling method followed by a bearish engulfing pattern. However, weekly chart is telling other wise - a long white candlestick and MACD buy signal so the weakness in the daily chart is probably a buy. For the past year, its weekly MACD buy signal works so I am still giving APC a week or two.

Also got faked in AGI. Weekly and daily chart looks very ugly. Should have taken whatever money it gave this week.

ELI started its recovery today. Spinning top after a decline would suggest sellers are losing control. ROC has also started to turn up so I am guessing it's about to advance in the short term. Weekly candlestick is showing a large doji which is bearish. Hopefully it opens higher this week.

NIKL is probably on correction mode.

Waiting for SCC to bounce before getting in. It seems like its going to consolidate in the short term within +/- 200 range.

AP seems to be forming a symmetrical triangle pattern(?). Also forming three stars in the south candle formations and RSI is back on its old support(39.59). Daily signs are mixed so I am not willing to bet on it yet.

Probably best to wait for:

1. Higher high (since it seems like to have formed a higher low already).

2. RSI bounce from 52 in the weekly chart.

All of the stocks that I am currently holding seems to have a normal bid/ask at the closing except NIKL which has 200k shares at 19.98.

RSI buy signal does seem to work on a 5-minute chart if the stock is range trading.

Thursday, January 20, 2011

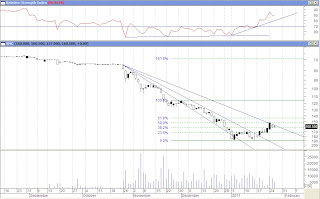

Nickel Asia (NIKL)

NIKL Daily Chart

From the looks of it, it is still a long way to go.

The higher end of the IPO price is my long term target.

From the looks of it, it is still a long way to go.

The higher end of the IPO price is my long term target.

Bleeding index is bleeding.

I am proud to say that everything I lost on the basura plays lately(plus the paper loss in ELI), I recovered back today with NIKL. NIKL is the superstar in today's session as it is bucking the Index lately. I completed my initial position in NIKL today. I wanted to add more but I didn't want to pull my average entry up too much. I will be waiting for a correction from 22 before I start adding up again.

Sold CYBR for a loss as my stops are hit during the early morning surge/slide.

APC has started to advance and it has now broke and closed above its resistance at 0.89.

Although ELI is still trading within expectations it is still losing(disappointingly). I'm still keeping it(prolonging losses) as it is somehow forming a bullish candlestick reversal pattern: Three starts in the south. Let's see how it goes in the short term.

Short term trading setup appeared in MEG and SCC. I'll toss a coin which one to trade tomorrow as I still have some cash after buying AGI for another quick range trading.

I'll post the chart of LC later as I couldn't get the clearance to trade it because of "moral issues".

The index lost another 33 points today. This suggests that the selling pressure is easing up and we are just about 6 points higher from the psychological support at 4k.

Let's see how things go tomorrow.

Sold CYBR for a loss as my stops are hit during the early morning surge/slide.

APC has started to advance and it has now broke and closed above its resistance at 0.89.

Although ELI is still trading within expectations it is still losing(disappointingly). I'm still keeping it(prolonging losses) as it is somehow forming a bullish candlestick reversal pattern: Three starts in the south. Let's see how it goes in the short term.

Short term trading setup appeared in MEG and SCC. I'll toss a coin which one to trade tomorrow as I still have some cash after buying AGI for another quick range trading.

I'll post the chart of LC later as I couldn't get the clearance to trade it because of "moral issues".

The index lost another 33 points today. This suggests that the selling pressure is easing up and we are just about 6 points higher from the psychological support at 4k.

Let's see how things go tomorrow.