The margin calls seemed to be abused by brokerage houses as they only need to push the prices just a little more after the huge drop from yesterday. I think the right term for it is "squeezing out of the trade". Like when somebody pushes up the price just a little higher than usual when there is alot of short bears. Bears take cover, pushing the prices higher. Then the one who pushed the price unloads his shares to the covering bears.

This is just a fruit of my wild imagination though. :P

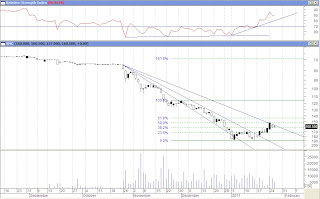

This is what happened in AGI during the first 30 minutes of trading:

I knew it was bound for a bounce so I wrote the text on the chart. I was deciding to close my entire position in AGI that time. I did not close it but sold the shares I got at 12.18 the day before at 11.28, right at the last doji after the steep decline. I needed the cash to increase position in NIKL. Right after I sold the shares, bam, somebody bought it up to 11.40. I was like, what the f? Anyway, I still have my original shares at 11.74 so the closing today is not bad.

Closig bid/ask looks pretty good to so I expect it to resume heading up by next week. Hopefully it breaks out of its pattern successfully next week.

I closed my position in SMC today despite of the bullish pattern that I was seeing in the 5-minute chart - ascending triangle. However, the target was only pointing at 185 - my original entry. So I closed the position.

With the cash I was able to generate from AGI and SMC, I increased my position in NIKL. I have increased my position in NIKL by 240% so I am pretty heavy in NIKL now.

INTRA INVEST has only sold 380k shares today. A little more than 4M shares to go.

Hopefully, everything recovers by next week so there would be a chance for us to unload/limit the losses. A dead cat bounce so to speak.