Disclaimer: The content posted in this blog is for informational purposes only and it should not be taken as an endorsement or solicitation to buy/sell the aforementioned issues. The information posted here is obtained through personal research and analysis, reserving the right to change them anytime. Investing in the money markets is accompanied by substantial risks to one's capital.

Tuesday, June 14, 2011

Monday, June 13, 2011

Trading update and FX: Trial by fire.

I tried to scalp earlier today despite of the crappy market this noon. Got my hands some papercut trying to trade XAU-USD and USD-CHF with my trend/volatility system despite of both being range bound. So I lost the $400 that I gain in EUR-USD the last time which I am trying to recuperate right now on EUR-USD again and I kinda recovered half of what's lost already.

I think it's alot better to trade EUR-USD than GOLD and CHF as I always have terrible fills in both GOLD and CHF.

Somehow, it feels like it's alot easier to trade on the short side?

Candlesticks doesn't seem to work on the 10-sec chart...

Maybe it's just my imagination.

Next time I'll make another demo account with smaller capital($1000) as I don't know if I can handle the $5000 account with maxed leverage on actual trading. Right now, I am trading the whole account in 1 position only with maxed leverage with a very tight stop.

*Ninja edit: My take profits point didn't get hit just now @1.4350 in my short position (EUR-USD).

Friday, June 10, 2011

FX: Trial by Fire

Day 2: -400$$ (US$5000 - Different account)

Day 3: +395$$ (US$5000 - Same account: D2 )

Day 4: -740%% (US$5000 - Same account: D2 )

Forex demo account : Trial by Fire.

Day 1

The first system that I tried was using was a 9-50 EMA crossover on a 30-sec chart, which takes both long and short position. At first I was impressed as it produced profits on both sides. But when I checked my trades, the crossover produced only a maximum of 8 pips which kinda sucks since I had been reading other people's disclosures of minimum of 100 pips. Then the choppy session came. The losses from the sideways session piled up together with the 8 pip gain that I didn't take, I was devastated and my head started to spin so I decided to take one final trade before calling it quits for the day. I went short on GOLD and slept.

The next day it had a 2.45. That's 2450 pips if I'm reading it right, right? I closed it because it was a half-meant trade so I am counting that one on pure dumb luck.

Lost 3600USD using the system in a 100k account(3.6% of capital).

**No idea on how pips work, where to put the stop loss, trailing stops, and proper position size to maximize the leverage. I didn't even know how buy/sell stops work lol.

Day 2

So I made a new account and put a more reasonable and realistic amount that I can actually put up. This time I used the triple EMA crossover (9-18-50). It also takes both sides of the trade. Disappointingly, it lost more than it won so I decided abandon it and used another system(buy above high-sell below low) which also failed miserably. lol.

Anyway, I started asking myself why the triple EMA crossover didn't work in FX while it worked and showed profitable results in the stock market. Then it got me thinking that I have to be on the right side of the market. With that in mind I decided to "zoom out" and check for 50EMA in longer time frames and trade with the 50EMA trend.

Got really tired so I decided to call it quits.

Lost 400USD using both systems in a 5000USD account(8% of capital).

Lesson: Trade with the trade. Don't take unneccessary trades. Sit tight when winning and set trailing stops. Don't be too eager to trade/wait for the right setup.

Day 3

I probably had the best trade today so far as I was able to gain $$50 above my starting capital haha. I lost it anyway when I started doing what I was doing in my first 2 days of FX trading. After losing the $$50 that I gained, I lost another $200 when I deviated from today's trading plan. After I reconized my own stupidity, I decided to FINALLY follow my trading plan LOL. So, I took the next trade and I was up by $200!!! But then I got really greedy I didn't put up a trailing stop! LOL!

So what do you expect from a pig other than get slaughtered?

Lesson: Don't be a pig and set trailing stops. Trade with the trend.

Let's see if I can break-even tonight. Currently short on EUR/USD.

*Trade setups. Trade with trend. Trade with trailing stops.

**I also tried selling lower and buying higher but both failed miserably. I probably should use them with the 50EMA.

***Currently using the triple EMA crossover in 1-minute chart + 50EMA on the 30-minute chart. Entry points are more often retested than not.

Thursday, June 9, 2011

Wednesday, June 8, 2011

AGI: Short term rally targets

Next 10.63

Best case 11.10

Tuesday, June 7, 2011

AGI

RFM: Capitulation(?)

Capitulation? Long black candle with spike in volume suggests panic selling. DMI(ADX) value has also reached the highest in the last six months. RSI value has also reached its lowest in the last six months.

However, despite of observations, I believe that it would be better to watch price action to stabilize first before taking any actions such as bullish divergence on daily and weekly charts and/or sideways breakout.

RSI has dropped below 30 on the weekly chart suggesting a parabolic drop is probably in the works.

LC bounced off support but met resistance at its WPP. LCB hardly retraced to its breakout point. LCB has better price action.

Attempting to predict LC top for tomorrow: 0.97.

URC seems to be forming a flag/pennant. Buying pressure appears to be building up.

AGI forming a bullish divergence on the daily chart? If yes then it could probably yield a 10% gain from its new trough(none as of this writing).

Not much issue to trade with, except for mining issues and other selected issues.

Didn't touch PWR, still unfamiliar with parabolic moves. Too scared to be the one left holding the empty bag.

P1 cash div in DMC, ex-date on the 10th of June. Yield is 2.41% using the recent close(41.40).

I'm liking the 5-minute divergences. I still need more practice!

LC

Since the last bearish divergence produced a 10% drop, I am going to assume that this bullish divergence will produce a 10% gain(at most) with an average of 4.5% gain for the mean time.

Monday, June 6, 2011

Juicy bullish divergence in LCB?

New positions in PX did pretty okay as PX close higher @20.80. It was only pushed up on the closing though. Still have unfilled buying orders.

Add on 20EMA pullback(daily and/or 5-min)?

Got trapped in LPZ so I decided to close the LPZ position despite the bullish divergence on the 5-min chart. Daily RSI just made another lower low, enough to warrant a sell, so I sold it for a small loss. Proceeds were used to buy PX.

AGI seems to be forming a bullish divergence. The only reason why one should avoid this is because it is in a steady downtrend.

It feels like 5-min divergences are pretty good in predicting intraday/short term swings. I only need to know where to take profits.

Still keeping my eyes on mining/momentum.

Friday, June 3, 2011

Breakout! - Not!

RSI is the give away here. But with LCB:

RSI looks pretty strong as it broke past 70!

Volume is very good too!

WHY?????!!! /wrist

*On a personal note, weekly charts appears to be bullish.

Does it really work that way or I just got lucky today? Need more test.

PX bounced off WPP/MR2(20) today but it looks like it is going to open lower by next week.

LPZ broke down from its 5-min trend line confirmed by RSI. Spread is still pretty wide. I should have placed my sell order @6.58 today. Looks like I'm going to be stuck in a triangle.

LC: Bearish divergence on 5-min chart

LC

I'll just make my own research then.

LC 5-min chart:

How low will you go?

Thursday, June 2, 2011

Chasing momentum

Sold all URC for commision loss + 0.4% loss.

Proceeds from both position were used to buy back PX. Calculated breakout entry is 21.15.

LPZ was pushed up at the closing, giving my position some superficial gain.

LC closed on high. Second day after breaking out.

LCB broke past 1 already.

Breakout buy seems to be working pretty nice.

"Buy stop",(calculated from last month's MPP,)for MER @257 was "hit" today. Unfortunately, I wasn't really watching it. It looks good now nonetheless as volatility and trading range is above average.

I was scanning the market last night for possible trades using RMO.

It gave buy "above-high" signals for Industrial and Mining-O indexes.

Same signals were found in LC and PX. On the other hand, I was thinking what possible play from the Industrial index. It never came to me that MER is under the Industrial index. Stupid me.

The All-shares index was also given by the system a buy-above-high signal.

A broad-base rally perhaps?

By the way, I heard that the US and EUR markets broke pretty bad last night.

Wednesday, June 1, 2011

Breakouts and volume

But how about this:

So is it really worth it to wait for breakouts with "very good" volume?

Would be buying on breakout on "mediocre" volume better?

GERI appears to be an exception to the group as the fundamental reason why it was rising was pretty obvious to the public.

Almost ceiling by PWR. No sellers at ceiling price though, probably trying to avoid investigation if price hits the ceiling.

AGI gap almost filled.

AP range trade.

DMC moving to fill the gap?

GERI closed at resistance level?

JGS bounced off 20EMA.

LC second day closed above 0.88. Breakout buy if close >0.89.

LCB look for minor pullback to 0.94.

MA momentum picking up despite 126 sells?

MEG look for a double bottom/failure swing low setup.

MER range trade? Wasn't really watching it but price spread probably is wide.

Place buy stop 240(?) and sell @250(?).

RFM is still on a steady downtrend. Looking forward to a steep drop.

SMC RSI buy signal today. Resistance @120?

SMDC range trade?

URC moving in boxes? If yes then close > 44, target = 46.

Tuesday, May 31, 2011

TEL looks ok for range trading but range is pretty small too (+/- 5%).

Today's action looks overly bearish.

ICT. Well, I dunno what's going on here. The MSCI inclusion issue perhaps? Looks like range trading too. 4% up, 4% down. Anyway, I am trading issues with more upside bias.

Proceeds used to buy LPZ. Position in now up from break-even level.

Free cash used to buy URC. Position is also up.

My previous analysis for LC is if closing price is higher than 0.88, it could propel the prices somewhere around 0.98. However, 121(MACQ) seems to pushed the price up at the closing. Breakout entry also says buy if close is higher than 0.89. Let's see.

LCB second day close above previous high(0.94). Breakout entry says buy if close is higher than 0.94.

Missed CEB. Today is probably the start of a new upswing. Daily up, weekly up. No reason not to go long.

Volatility back in BEL and GERI? LR is the weakest among the group.

Volatility is also back in AEV. Not really watching them lately. My attention was range trading mining issues.

Range trade AP. Range is ok but a little tight though. +/- 6%. Drop back to 28 can?

Look for a pullback-entry in EDC? 50EMA pullback perhaps?

Good thing I sold PX yesterday after that ugly-as-fuck candle pattern. Let's see if 20 holds as support. Gap @19.36-19.26. Gap filled: Good. Gap not filled: Better.

Monday, May 30, 2011

Saturday, May 28, 2011

CEB

But it did:

It retraced to 61.8% Fib levels. Nonetheless, it provides a relatively good short term upside at current levels up to the recent high of 98.

All we need now is positive(weekly/daily) momentum.

Confirmation of move this week:

Even if this is just an A-B-C correction(in a downtrend), you'd still have one profitable leg/trade.

Friday, May 27, 2011

Universal Robina Corp (URC)

It was suggested that the wave 3 is the longest wave. If I recall it correctly, wave 3 is like x2-x3 of wave 1.

Please take note that I do not practice Elliot wave theory, thus this is just one crazy idea that I have.

Trader's Toolbox: Reversals

1. The market must make a new high for the last six to eight weeks.

2. The market must close lower than the previous day’s (or week’s) close.

3. The market must reverse the previous day’s (or week’s) action.

5. Fifth, the reversal must be accompanied by moderate to high volume. And, finally, the reversal must occur in a terminal (critical) area.

From CLUB.INO.COM. Original post linked on the title.

Philex Mining (PX)

My initial entry is @19.22(1) but I decided to sell 60% of the position(2) that resulted -0.06% of capital as the price of LC that day looked pretty attractive.

Thursday, May 26, 2011

Wednesday, May 25, 2011

Proceeds used to buy additional LC @0.81.

Free cash used to buy additional LC @0.78.

Only 1 losing position in LC, bought @0.85.

I'd probably lighten up somewhere 0.90+ but if this one closes higher than 0.88, I'd probaby hold for the meantime.

AGI broke down/gap down and closed below support @11.

DMI sell signal on daily and weekly chart.

wRSI broke down.

Triple EMA breakdown.

Pattern breakdown target: 9.12.

Medium term support: 10.

AP weekly 50MA/Pattern support: 27.

wRSI broke support.

AT Range trade. Trading range 16-18. Possible trend candidate. wMACD Buy signal.

CMT support 1.20.

LCB possible doji setup.

LR possible doji setup.

MA gap support @0.039 held(?)

MER MPP possible penetration. Buy stop @257.

PX weekly reversal pattern. wRSI sell signal. Watch price movement at wRSI support.

SMDC range trade. Trading range 8.50-9.50.

SMPH breakout candidate. Normal resistance @12. Trading range 11.50-12.

URC WPP buy signal.

PSEi is bearish. New RSI low but index is still not making new lows.

All shares index looks like holding up(RSI support).

Financial sector is forming successive lower RSI highs(bearish divergence). DMI sell signal today.

Holding sector is forming successive lower RSI highs(bearish divergence) and currently trending down but trend strength is starting to pick up.

Industrial sector is holding up(RSI support) but currently trending down and trend strength is starting to pick up.

Mining sector is holding up(RSI support) with a possible short term reversal play(doji setup).

Property sector appears to be in a weak downtrend.

Service sector appears to be in a weak downtrend.

Tuesday, May 24, 2011

FGEN

I think it's better to wait for weekly RSI 40 for the mean time.

I really thought that the 10-min downtrend in LC is about to end when it went the other way around today so I decided to place a barat bid @0.78 which didn't get hit today.

121 bought up alot of shares yesterday @0.85. 121 sold alot of share today @0.83.

I'd probably add some in PX tomorrow if it starts recovering by then.

Finally some volatility in AGI! I am really tempted to buy some earlier but I didn't. I would be waiting for a confirmation tomorrow but if AGI drops to 10.50 levels, I think I would jump on it. Bullish divergence on the 10-min chart suggests a short term bottom is just around the corner.

Or place a buy stop in BEL? Range looks pretty good and can be traded.

Monday, May 23, 2011

Issues that I am looking at this week are AT/BEL - range trading, PX/LC/B/URC - trending with LC/B/URC completing a 1-2-3 pullback setup and finally CEB for a pullback after a breakout setup.

I think LC needs to close higher than 0.88 to continue heading up.

Hopefully, CEB closes somewhere @90 this week to confirm my theory.

I am confused with URC's price movement. I am wondering if today's price action completed it's 1-2-3 pullback today. Lemme see my notes...

No idea what happened to MEG today.

I love small red candles. <3

Sunday, May 22, 2011

Manila Mining (MA)

Here's one of the reasons why I stopped trading with candlesticks(well I still do trade with doji candles though):

A hammer followed by a bullish engulfing = $$ right? Not this time. Had you traded it that way, you are down by 6% or so in the trade already plus another 6% or so, depending on your position size while waiting for your stop to be hit.

Or maybe, I am doing it all wrong. Perhaps wait for the gap to be filled/position at the gap instead?

I'll toss a coin if I would place a barat bid at 0.036.

Friday, May 20, 2011

Thursday, May 19, 2011

Click here for the original post: http://www.investmentu.com

A Position Sizing Lesson: Why Size Matters to All Investing Greats

By Brian Hunt, Contributing Editor

Tuesday, May 25, 2004: Issue #340

I made four times my money in JDS Uniphase. But I made one mistake with JDS Uniphase: I didn’t put enough money into the trade, and picked up a valuable lesson on position sizing. It was early 2000, near the top of the bubble, and I was getting used to making 100%-plus returns.

Reading a popular investment newsletter, I fell for the hype surrounding another tech stock, LSI Logic but I wouldn’t make the same “mistake” I did with JDS Uniphase.

“If I’m going to make four times my money again, I’m doing it with over half my portfolio,” I thought.

But something awful happened on the way to the bank: Instead of soaring in value and making me rich, LSI Logic tanked. I was out $23,000 – more than I would even spend on a car!

The LSI Logic loss was brutal, and it wasn’t the only stock I lost money on. So I decided to make a big change. I couldn’t lose that kind of money again.

I left the markets for over a year to study to find out what professional investors do that I didn’t do.

Here’s what I learned…

Position Sizing is What the Pros Do that Novices Don’t

I made all kinds of mistakes starting out, like trying to make a quick buck and buying the most popular stocks but the biggest mistake was ignoring position sizing as a powerful investing concept.

It’s amazing how few investors even consider how much money to place into one investment. That’s all position sizing is the part of your investing strategy that tells you “how much” to place into any one investment.

Position sizing provides the answers to these questions:

- Should you place 10% of your money into one stock?

- How about 50% of your money?

What All Great Traders Have in Common

After taking several big losses in my account, I decided to learn from the greats. I read a book called Market Wizards, and discovered the world’s most successful investors used position sizing by putting only a tiny portion of their money (generally 1-2%) at risk on one idea.

I then learned the specifics of position sizing from the book, Trade Your Way To Financial Freedom, by Dr. Van K. Tharp. After studying thousands of successful traders, Dr. Tharp learned that every trader making millions in the market is fanatical about using position sizing to control risk.

Here’s How You Can Use Position Sizing in Your Own Portfolio

Let’s say you have $100,000 to invest and you’re using the 1% risk model to guide your investments. If you’re using a 25% stop loss, you could buy $4,000 worth of stock and risk $1,000 ($1,000 is 1% of $100,000).

In the example above, you placed 4% of your portfolio into the stock and set a 25% stop – risking just $1,000 of your money (since $1,000 is 25% of $4,000).

Some investors use even tighter stops, in the 10%-15% range.

If you’re using the 1% risk model with a 10% stop loss, you could buy $10,000 worth of stock. You have the same dollar amount at risk ($1,000) as the first example – but you’re allowing the stock less room to go down before you sell.

Now I use smart position sizing – and I never worry about taking big losses like I did with LSI Logic. Take a look at your portfolio today and make sure you know “how much” you have at risk. That way you’ll be prepared regardless of what happens with any one position.

Breakout buy entry

Wednesday, May 18, 2011

Finance Manila: Trading Systems, Methods & Resources

Trading Systems, Methods & Resources from Finance Manila (financemanila.net).

Lots of stuff to learn in the thread. Too bad it isn't sticky-ed on FM so I'll be keeping a link for a more direct access instead of digging it from the grave. Worth every time spent reading when one needs guidance.

Haters gonna hate.

Despite my vow not to go/read forums anymore, I still did as I am bored as hell during trading sessions plus there's really nobody to talk to with regards to stock trading among my friends. Anyway, I am holding LC as my core position now so I frequent the LC thread in Finance Manila.

Tuesday, May 17, 2011

Manila Mining Corp "A"

Here are the reason's why I wanted to buy it:

RSI is resting at its support with negative ROC flattening out suggesting the correction is over.

Maybe I should have bought since I was feeling afraid lol. Anyway, confirmation of the next move is tomorrow.

Today is probably the worst day for DMC. -11.70% in one day just because it wasn't included in MSCI(unexpected)?

No way in hell for me to catch the move in ICT today. Will it continue to go higher? I have no idea but I hope it fades the gap back to 55 at least. It is trading another all time high though.

Bought some FLI today @1.25. Let's see how things go from here.

LC is breakeven. :((

Trading tools are back. My current system is for trending stocks, which sucks and prone to buy high sell low in ranging markets.

Sunday, May 15, 2011

JGS

DMI reading suggests strong uptrend so I think buying on pullbacks on 9SMA or 20EMA can be applied to trade this one.

Pullback after breakout(26.55 - bounce) can also be applied for a better position.

Gokongwei stocks are definitely moving.

Thursday, May 12, 2011

Most of the issues right now appear very heavy or this is just the much needed correction? I think I was right on the overly bullish move of DMC yesterday. The momentum of JGS also come to a stop. No stops are hit so no selling yet.

After the huge drop in RFM yesterday, it made a nice recovery today. 5% in a day is nice but looking from its transactions, it appears to have wide spreads so I think I'll pass for the mean time.

What pulled down the market btw?

Wednesday, May 11, 2011

Turns out I read JGS right. Either I buy at the open tomorrow or apply new-high-setup too.

Isn't RFM undervalued already? FY10 income report came out today, growing by 71.4% and the stock drops by 7.95%? I do not understand. Charts later if I don't get too wrapped up in playing Dragon Age 2.

Tuesday, May 10, 2011

Monday, May 9, 2011

52-week new high on Friday rule

“The 52-week new highs on Friday rule” is usually applied to the market itself and not to an individual stock.

Rule number 1: On a new 52-week high, when the market closes at or close to its high on a Friday, buy long and go home long for the weekend.

Rule number 2: Exit the long position on the opening the following Tuesday.

Rule number 3: If the market opens lower on Monday, exit the position immediately.

Originally shared by Shoyu Ramen in Finance Manila. Hope he doesn't mind me posting this one out here(sharing to other people and for personal use). Will take this one down if he doesn't want other people posting his stuff.

*Originally from Ino.com. Click the title for the original video/lesson.

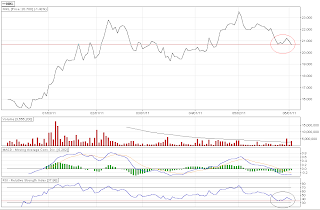

Gold ($GOLD - Continuous Contract (EOD)) Index

Bounce from RSI-50 is a bonus. Stop-loss depends on one's risk appetite.

Take profits when you're happy.

I finally got a buy signal from JGS I am comfortable with so I put up a relevant position in it. Added some more LC. BDO seems recovering already.

My LC in the PSE-STG is already up by 46.55%! Lol. If I only had the balls when it first made its "new high" then. Oh well.

GEO had a private placement today (950M shares) at par. I hope it doesn't gap tomorrow. I'll be putting my "barya" there tomorrow.

Market, please be good so I can buy my own place. <3